Negative oil prices chart information

Home » Trending » Negative oil prices chart informationYour Negative oil prices chart images are ready. Negative oil prices chart are a topic that is being searched for and liked by netizens now. You can Get the Negative oil prices chart files here. Get all royalty-free vectors.

If you’re looking for negative oil prices chart images information connected with to the negative oil prices chart keyword, you have pay a visit to the right blog. Our website frequently gives you hints for seeking the highest quality video and image content, please kindly search and find more informative video content and graphics that fit your interests.

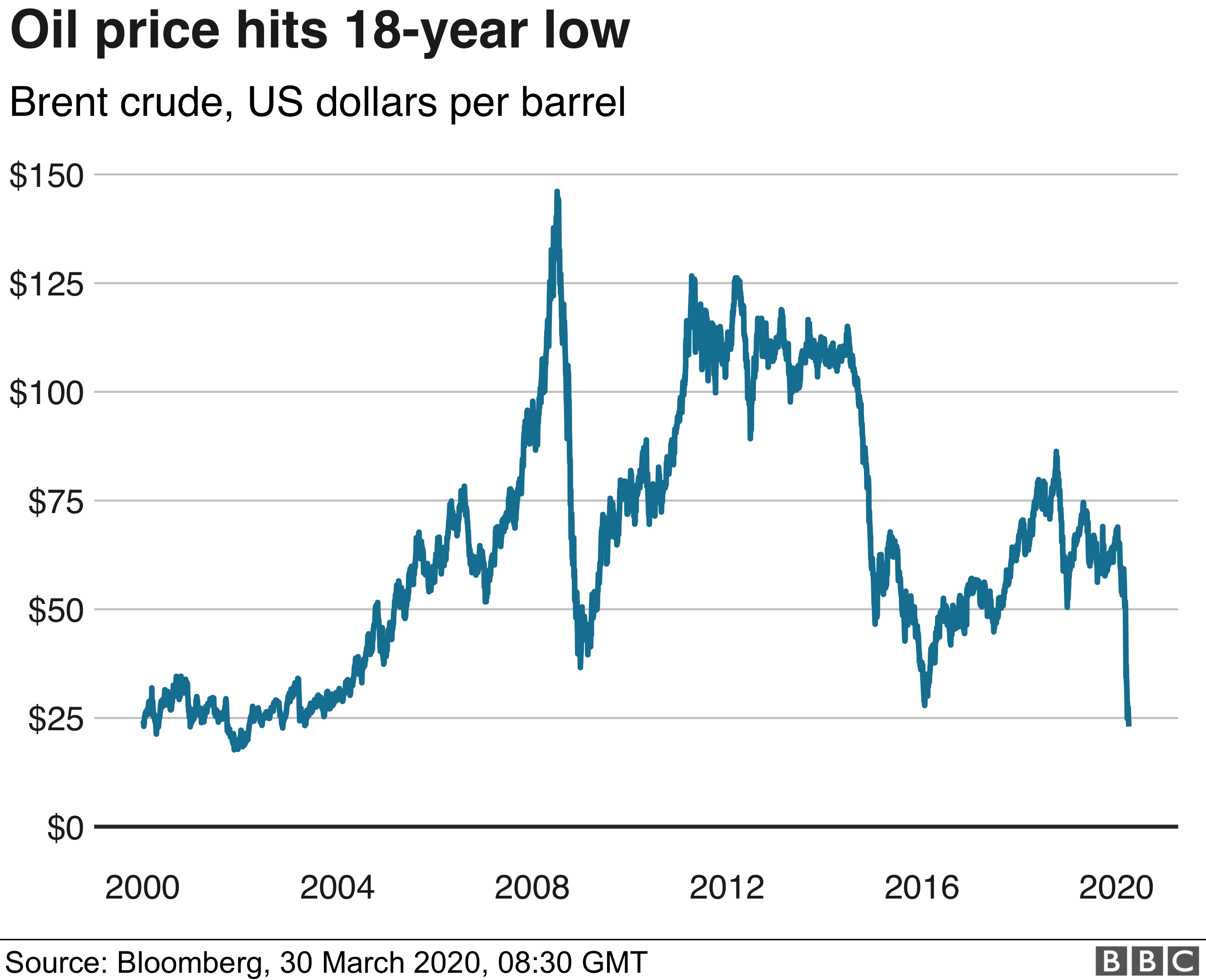

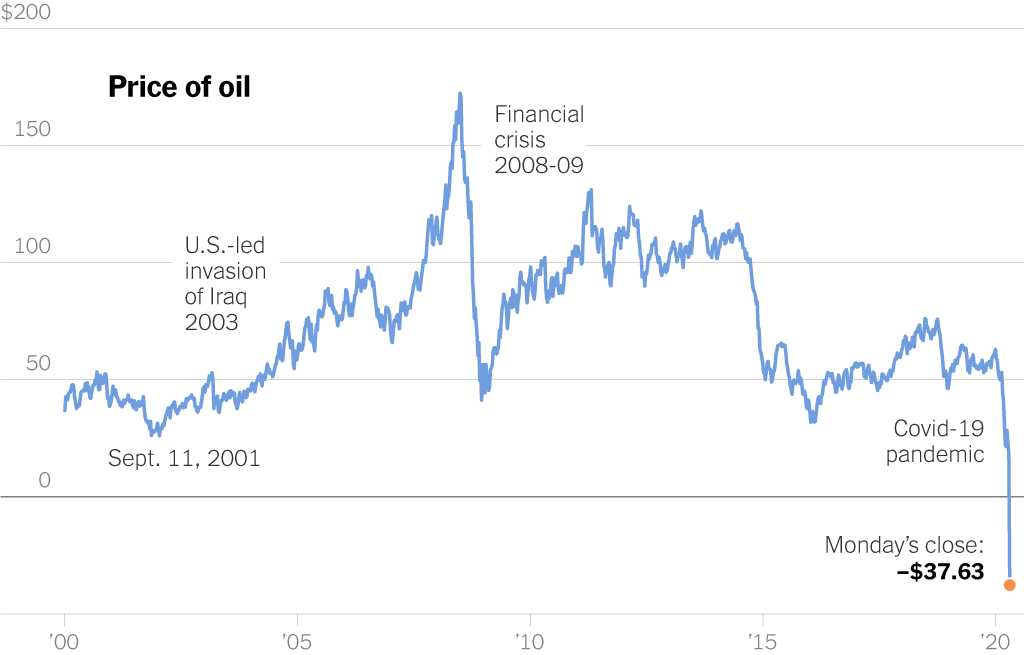

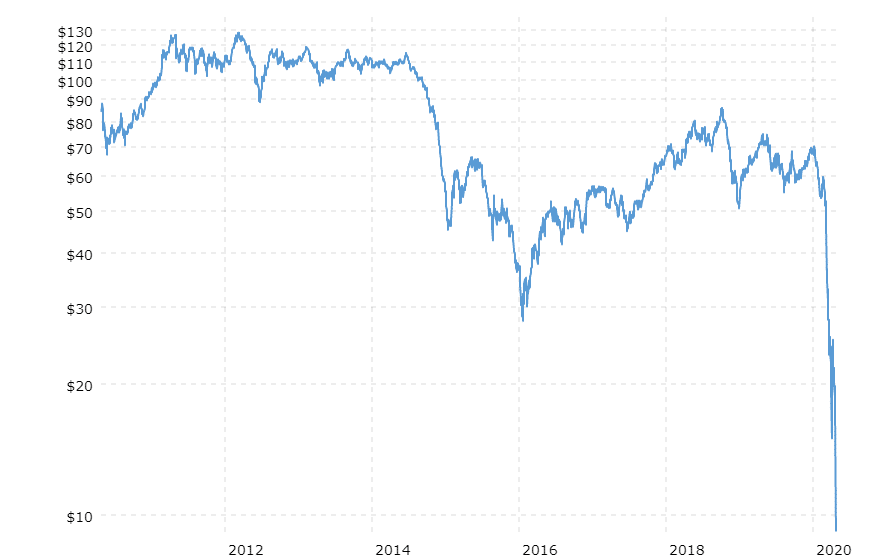

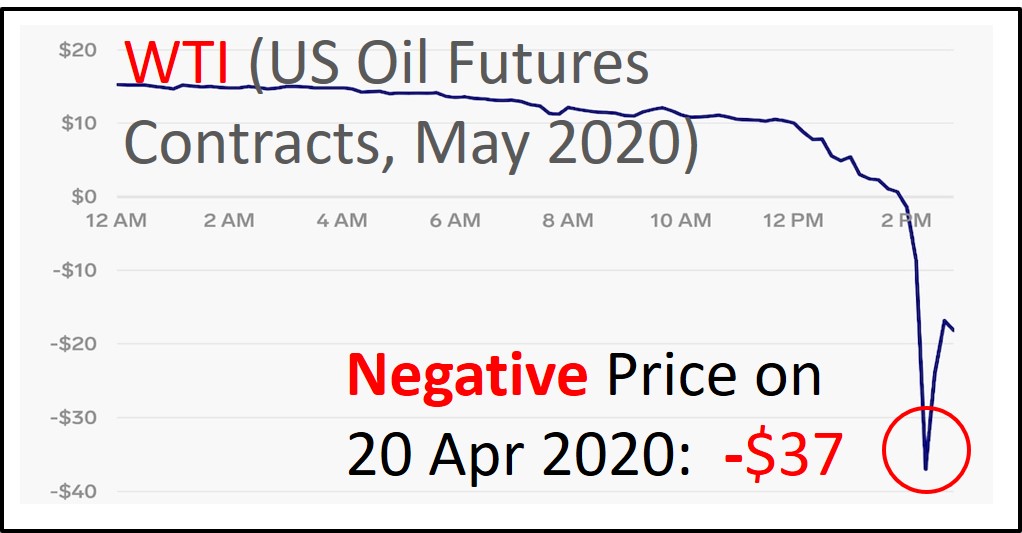

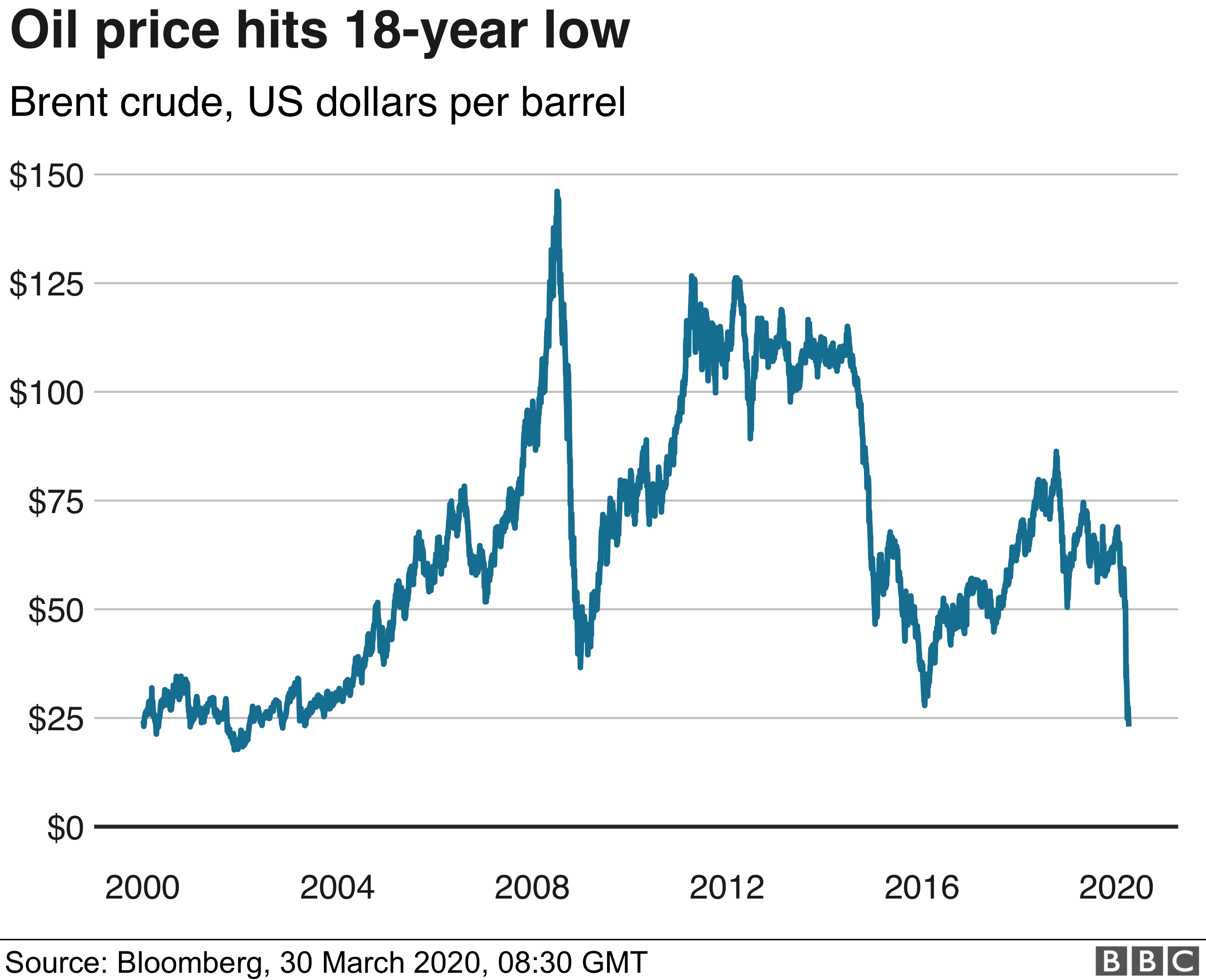

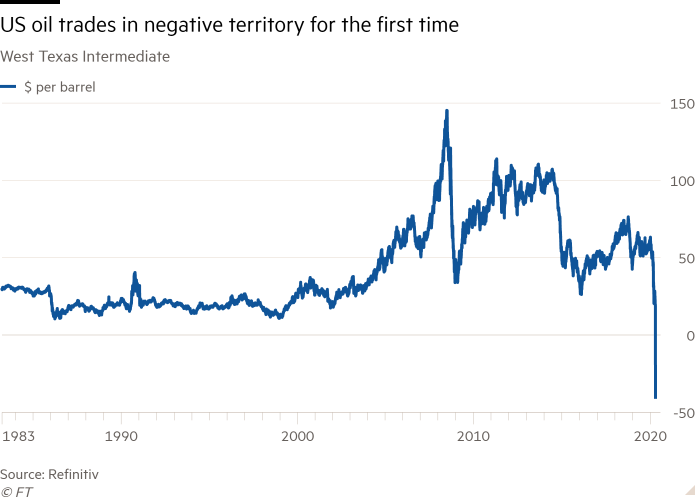

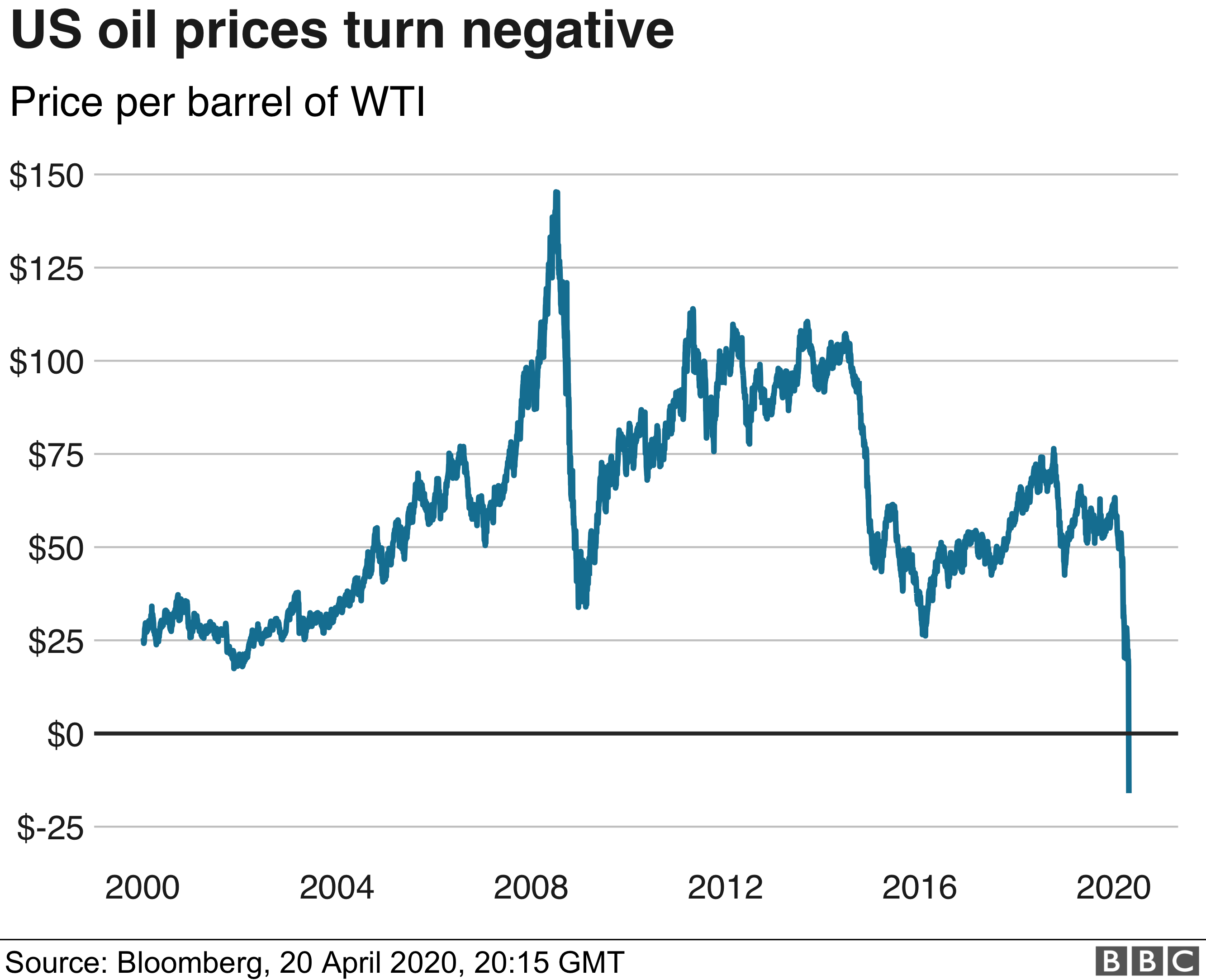

Negative Oil Prices Chart. If everyone is buying oil, and all the wells are pumping at capacity, there is very little reason for a price to go down, because you cannot increase production. The formerly unthinkable drop in oil prices below $0 a barrel on monday is still reverberating through financial markets, as supply overwhelms demand. The price of a barrel of west texas intermediate, which is the benchmark for us oil, started trading at a negative price today for first time. On monday we can expect market to retrace till 63.6 to 63.8 levels based on trendline and then we can expect downward movement only if trendline is.

Oil price drops below 18 per barrel in the U.S From geoengineer.org

Oil price drops below 18 per barrel in the U.S From geoengineer.org

The consequences for the u.s. Oilprice.com, in cooperation with its partners, offers over 150 crude oil blends and indexes from all around the world, providing users with oil price charts, comparison tools. Crude oil futures prices turn negative april 22, 2020 what happened? Price inelasticity of supply is why predictions of $200 or $400 per barrel oil are not silly. Negative oil prices and sad stat data. Given this impaired liquidity, speculators are forced to sell oil at negative prices, essentially paying someone for taking the oil off their hand.

Us oil benchmark west texas intermediate (wti) fell from $17.85 at the start of the trading day to negative $37.63 by the close.

Us oil benchmark west texas intermediate (wti) fell from $17.85 at the start of the trading day to negative $37.63 by the close. This comes at a time when opec+ have agreed to cut output by 10million barrels a day in an attempt to stabilise oil prices. This paradox of negative price can occur because there is no free disposal of the asset. We wrote about the reasons for. The oil price charts offer live data and comprehensive price action on wti crude and brent crude patterns. The consequences for the u.s.

Source: dailyfx.com

Source: dailyfx.com

Us oil benchmark west texas intermediate (wti) fell from $17.85 at the start of the trading day to negative $37.63 by the close. 53 rows in april 2020, prices for a barrel of oil fell to an unprecedented negative. This paradox of negative price can occur because there is no free disposal of the asset. Benchmark west texas intermediate crude futures made history by trading and settling in negative territory, and while prices have recovered to trade. Us oil benchmark west texas intermediate (wti) fell from $17.85 at the start of the trading day to negative $37.63 by the close.

Source: shacknews.com

Source: shacknews.com

It痿冱 been a year since u.s. Much like toxic waste or even Price inelasticity of supply is why predictions of $200 or $400 per barrel oil are not silly. Negative oil prices and sad stat data. Benchmark west texas intermediate crude futures made history by trading and settling in negative territory, and while prices have recovered to trade.

Source: thedeepdive.ca

Source: thedeepdive.ca

Crude crashed into negative territory for the first time ever, signaling the extreme disconnect between supply and demand as storage tanks. Get information on key pivot points, support and resistance and crude oil news. Oil (wti) price per 1 gallon. It�s all a bit technical , but basically, tuesday represented a deadline to find a. Crude oil futures prices turn negative april 22, 2020 what happened?

Source: jpmorgan.com

Source: jpmorgan.com

Oil prices are negative for first time ever — quartz The price of a barrel of west texas intermediate (wti), the benchmark for us oil, fell as low as minus $37.63 a barrel. Negative oil is the equivalent of getting paid by your local starbucks. Much like toxic waste or even Oilprice.com, in cooperation with its partners, offers over 150 crude oil blends and indexes from all around the world, providing users with oil price charts, comparison tools.

Source: thefreegyaan.com

Source: thefreegyaan.com

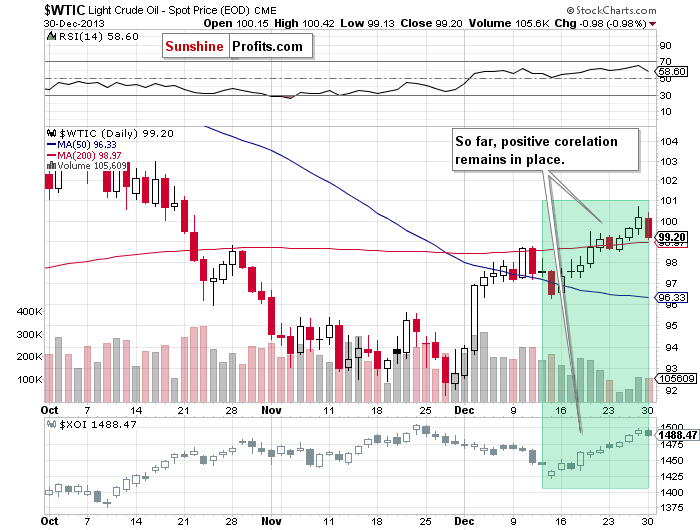

Year average closing price year open year. Those prices—at negative $4.47 per barrel—mean that companies must now pay a buyer to take oil off their hands and store it if they want to exit the market. The price of west texas intermediate fell off a cliff and then some, to negative $36.20, the lowest point since bp began keeping records in 1861. 53 rows in april 2020, prices for a barrel of oil fell to an unprecedented negative. Trendline broken at 64.5 and we can see bearish movement till 63.

Source: sunshineprofits.com

Source: sunshineprofits.com

If everyone is buying oil, and all the wells are pumping at capacity, there is very little reason for a price to go down, because you cannot increase production. The price of a barrel of west texas intermediate (wti), the benchmark for us oil, fell as low as minus $37.63 a barrel. Oil (wti) price per 1 ton. Get information on key pivot points, support and resistance and crude oil news. Benchmark west texas intermediate crude futures made history by trading and settling in negative territory, and while prices have recovered to trade.

Source: ein55.com

Source: ein55.com

It痿冱 been a year since u.s. It�s all a bit technical , but basically, tuesday represented a deadline to find a. This demonstrates that in the face. The may futures contract price fell $55.90 during the day, to close at negative $37.62 per barrel. The price of west texas intermediate fell off a cliff and then some, to negative $36.20, the lowest point since bp began keeping records in 1861.

Source: geoengineer.org

Source: geoengineer.org

Trendline broken at 64.5 and we can see bearish movement till 63. The formerly unthinkable drop in oil prices below $0 a barrel on monday is still reverberating through financial markets, as supply overwhelms demand. As lockdowns forced factories to close and people to stop travelling, our global demand for oil has reduced by 29 million barrels a day. On monday we can expect market to retrace till 63.6 to 63.8 levels based on trendline and then we can expect downward movement only if trendline is. Oilprice.com, in cooperation with its partners, offers over 150 crude oil blends and indexes from all around the world, providing users with oil price charts, comparison tools.

Source: aier.org

Source: aier.org

We can interpret this as the asset (oil delivered in may) became a liability. Negative oil prices and sad stat data. This comes at a time when opec+ have agreed to cut output by 10million barrels a day in an attempt to stabilise oil prices. Benchmark crude, went negative (see figure 1). Us oil benchmark west texas intermediate (wti) fell from $17.85 at the start of the trading day to negative $37.63 by the close.

Source: chonfm.com

Source: chonfm.com

Benchmark west texas intermediate crude futures made history by trading and settling in negative territory, and while prices have recovered to trade. The price of west texas intermediate fell off a cliff and then some, to negative $36.20, the lowest point since bp began keeping records in 1861. In a massive and unprecedented swing, the future contracts for may delivery of west texas intermediate tumbled to minus $37.63 a barrel. Much like toxic waste or even Oil (wti) price per 1 gallon.

Source: learnenglishwithwill.com

Source: learnenglishwithwill.com

Oil prices are negative for first time ever — quartz Oil prices are negative for first time ever — quartz It痿冱 been a year since u.s. As lockdowns forced factories to close and people to stop travelling, our global demand for oil has reduced by 29 million barrels a day. It�s all a bit technical , but basically, tuesday represented a deadline to find a.

Source: thefreegyaan.com

Source: thefreegyaan.com

How are negative oil prices even possible? Benchmark crude, went negative (see figure 1). Get information on key pivot points, support and resistance and crude oil news. As lockdowns forced factories to close and people to stop travelling, our global demand for oil has reduced by 29 million barrels a day. 1 barrel = 42 gallons.

Source: wolfstreet.com

Source: wolfstreet.com

Benchmark crude, went negative (see figure 1). The price crash in west texas intermediate crude is a nasty sign of a deeply dislocated market. In a massive and unprecedented swing, the future contracts for may delivery of west texas intermediate tumbled to minus $37.63 a barrel. The price of a barrel of west texas intermediate, which is the benchmark for us oil, started trading at a negative price today for first time. A negative oil price is nothing for any american to celebrate, because anyone who believes the economic damage it reflects will be limited to the oil and gas business is.

Source: wildlikeclick.com

Source: wildlikeclick.com

April 20th, 2020 was the first day in history where oil recorded negative prices. Benchmark west texas intermediate crude futures made history by trading and settling in negative territory, and while prices have recovered to trade. 53 rows in april 2020, prices for a barrel of oil fell to an unprecedented negative. The price crash in west texas intermediate crude is a nasty sign of a deeply dislocated market. Crude crashed into negative territory for the first time ever, signaling the extreme disconnect between supply and demand as storage tanks.

Source: legacyias.com

Source: legacyias.com

This demonstrates that in the face. The price crash in west texas intermediate crude is a nasty sign of a deeply dislocated market. The price of a barrel of west texas intermediate (wti), the benchmark for us oil, fell as low as minus $37.63 a barrel. As lockdowns forced factories to close and people to stop travelling, our global demand for oil has reduced by 29 million barrels a day. A negative oil price is nothing for any american to celebrate, because anyone who believes the economic damage it reflects will be limited to the oil and gas business is.

Source: malaybaba.blogspot.com

Source: malaybaba.blogspot.com

This paradox of negative price can occur because there is no free disposal of the asset. The price of a barrel of west texas intermediate (wti), the benchmark for us oil, fell as low as minus $37.63 a barrel. Oil prices are negative for first time ever — quartz This comes at a time when opec+ have agreed to cut output by 10million barrels a day in an attempt to stabilise oil prices. Get information on key pivot points, support and resistance and crude oil news.

Source: aier.org

Source: aier.org

What negative us oil prices mean for the industry | free to read. On monday we can expect market to retrace till 63.6 to 63.8 levels based on trendline and then we can expect downward movement only if trendline is. The may futures contract price fell $55.90 during the day, to close at negative $37.62 per barrel. 1 barrel ≈ 0,136 tonnes of crude oil. Much like toxic waste or even

Source: jpmorgan.com

Source: jpmorgan.com

As lockdowns forced factories to close and people to stop travelling, our global demand for oil has reduced by 29 million barrels a day. A more realistic market price was the average price for all of 2019 of $50.01 (inflation adjusted $54.99) which is still about half of the 2014 price. It�s all a bit technical , but basically, tuesday represented a deadline to find a. Given this impaired liquidity, speculators are forced to sell oil at negative prices, essentially paying someone for taking the oil off their hand. On monday we can expect market to retrace till 63.6 to 63.8 levels based on trendline and then we can expect downward movement only if trendline is.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title negative oil prices chart by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Manchester united home jersey information

- Manchester united long sleeve jersey information

- Big 10 tournament bracket results information

- Lil bo weep forever lyrics information

- International womens day 2022 ukraine information

- Iowa vs xavier basketball information

- Outlander knitting patterns free information

- Tottenham vs everton tv us information

- International womens day disney information

- Bill cosby victoria valentino information