Oil prices and recession graph information

Home » Trend » Oil prices and recession graph informationYour Oil prices and recession graph images are ready in this website. Oil prices and recession graph are a topic that is being searched for and liked by netizens today. You can Download the Oil prices and recession graph files here. Get all free vectors.

If you’re looking for oil prices and recession graph pictures information linked to the oil prices and recession graph interest, you have visit the right blog. Our website always gives you suggestions for refferencing the highest quality video and picture content, please kindly hunt and find more informative video content and images that fit your interests.

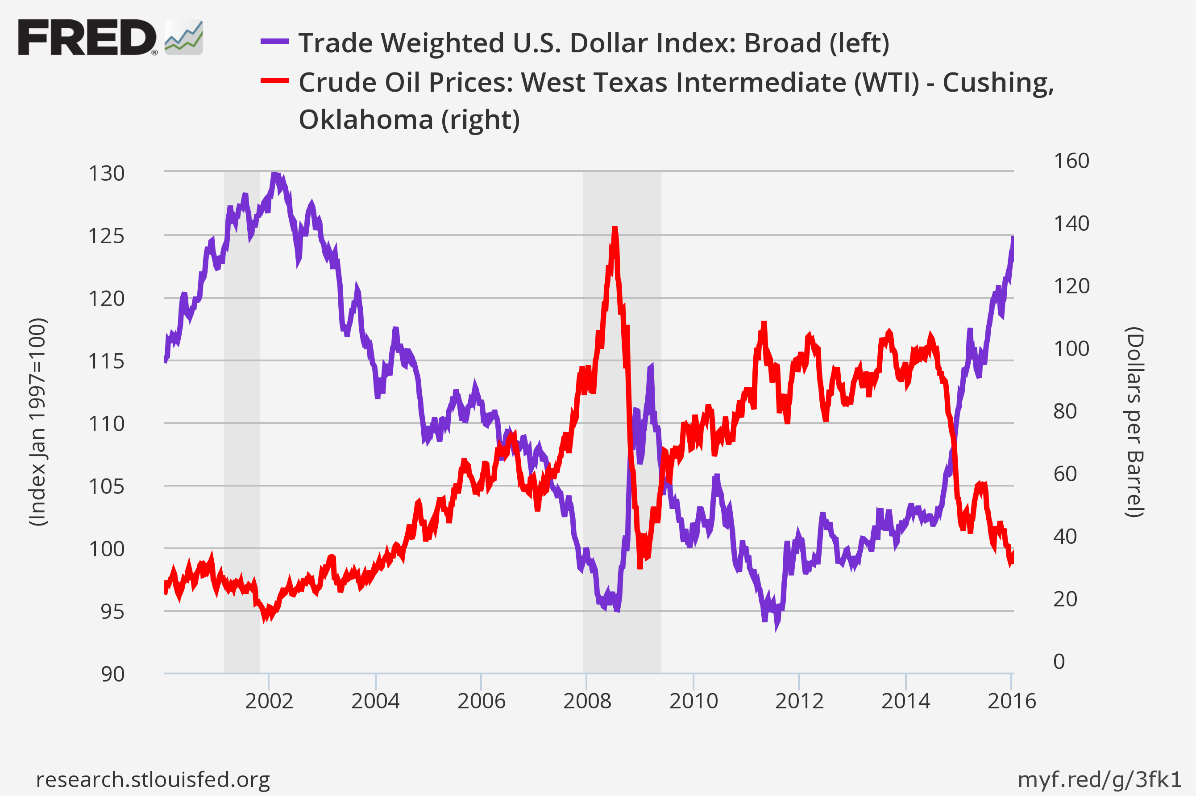

Oil Prices And Recession Graph. Jeff rubin�s graphic showing connection of oil prices and recessions. Crude oil prices & gas price charts. In the past 50 years, every time oil prices, adjusted for inflation, rose 50 per cent above trend, a recession followed, data from luca paolini, chief strategist at pictet, shows. Year average closing price year open year.

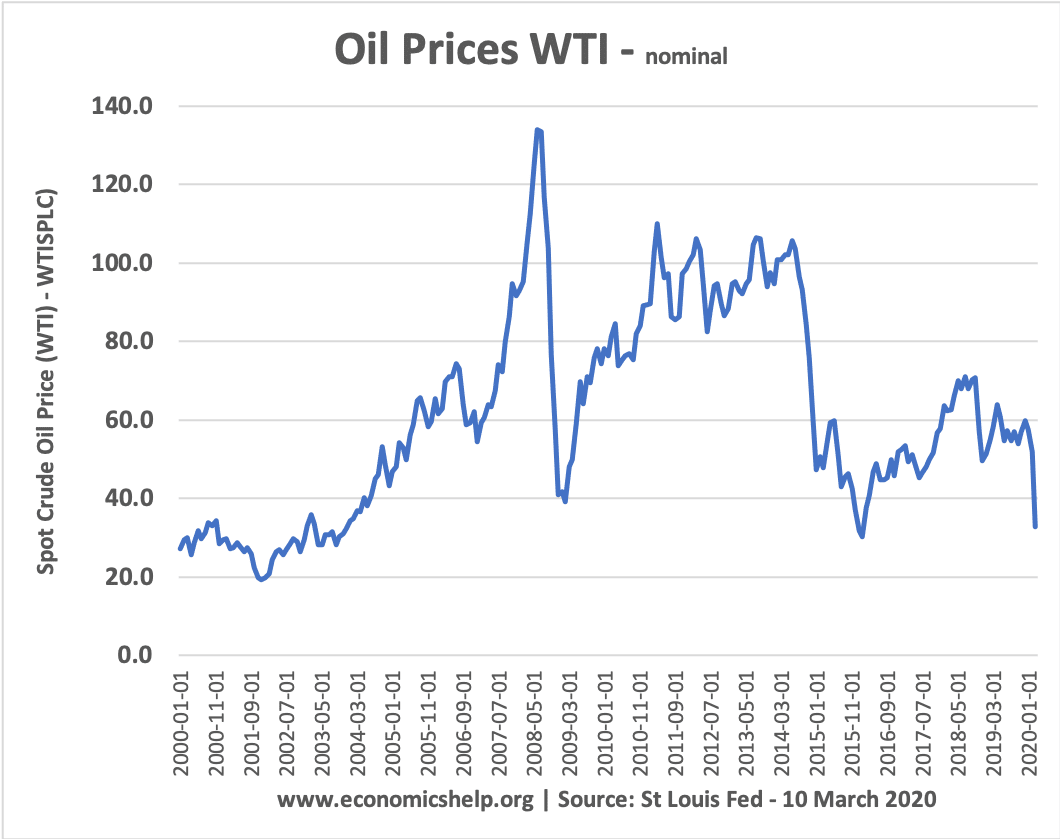

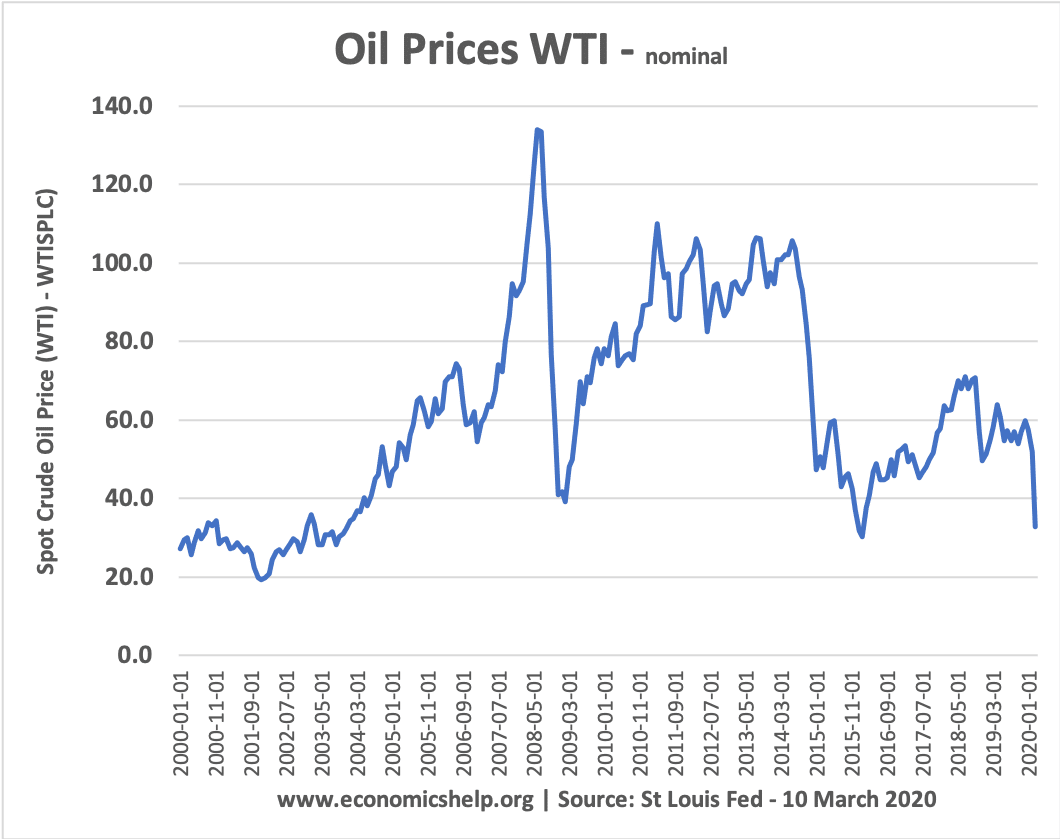

Effect of falling oil prices Economics Help From economicshelp.org

Effect of falling oil prices Economics Help From economicshelp.org

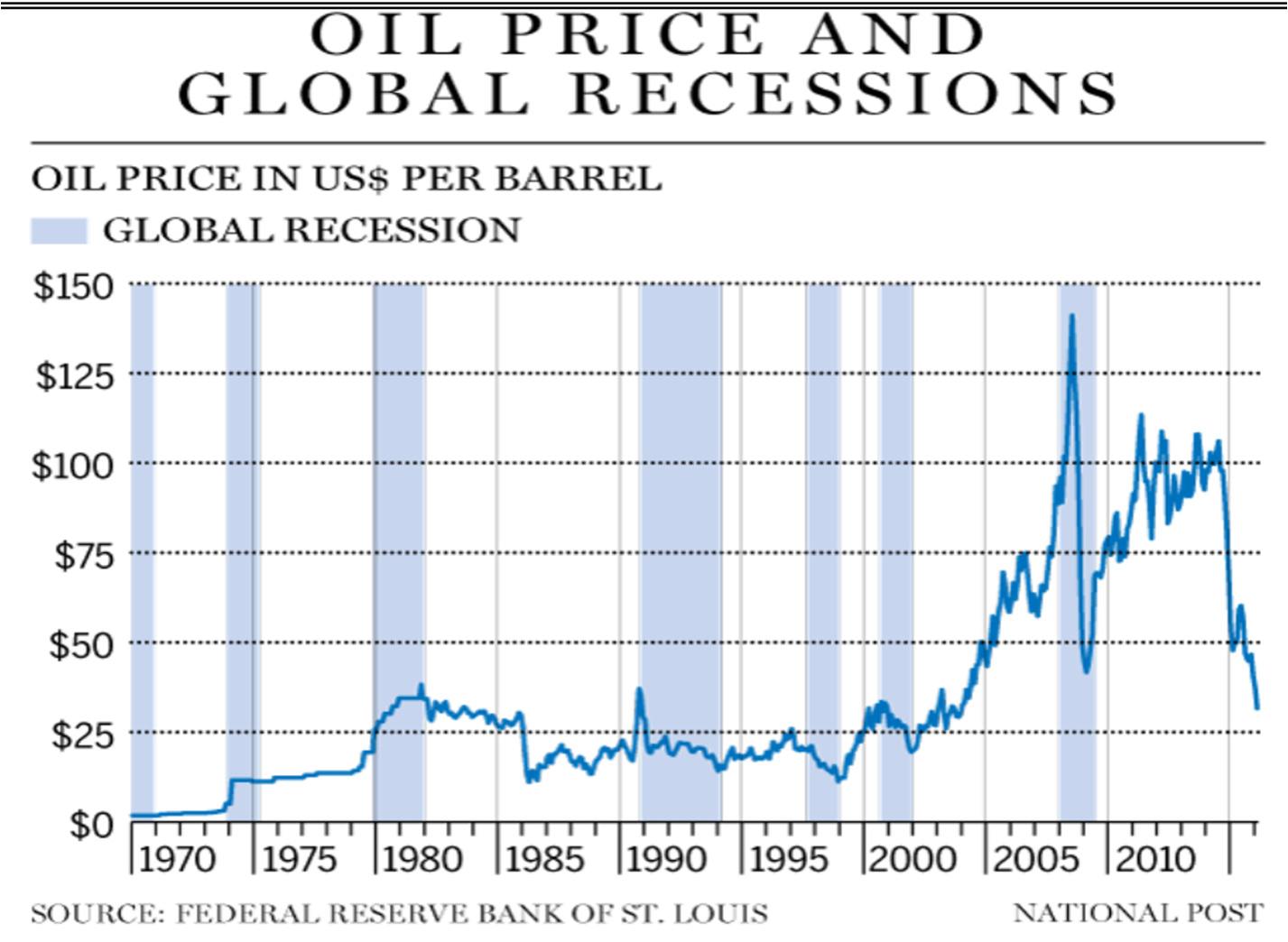

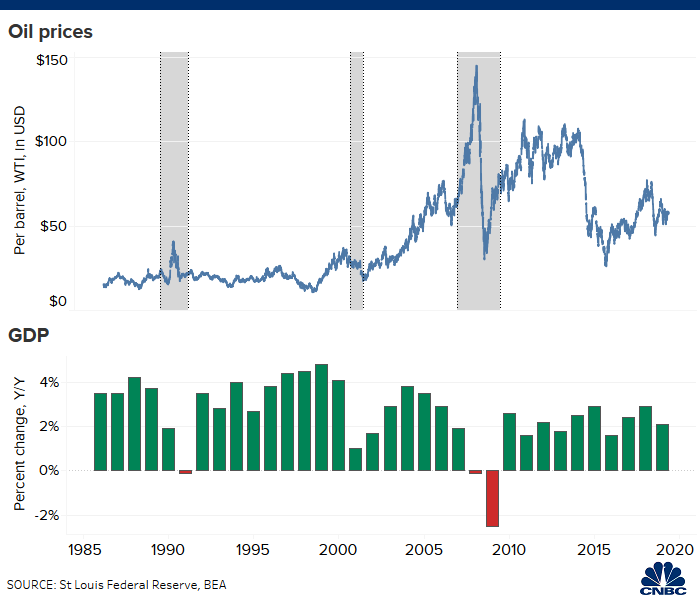

This graph shows two periods where high oil prices were shortly followed by a recession. Jeff rubin�s graphic showing connection of oil prices and recessions. During the previous peak price back in 1979, the nominal monthly average oil price peaked at $38 per barrel (although the intraday prices spiked much higher). The outlook for oil prices is driven largely by global economic growth, but it’s a. Many others have produced versions of this chart which may vary from country to country. On november 5, 2008, i wrote a post called jeff rubin:

The graph shown in the wsj is very familiar.

Jim bianco, president of bianco research, recently argued that “every 50% rise in crude [oil’s price] has led [to] a recession.” that’s a worrisome omen indeed, since oil’s. Oil production, receding geopolitical concerns, and shifting opec policies. For example, oil price shocks explain a 3 percent cumulative reduction in u.s. Oil prices have increased significantly from their pandemic lows and are substantially higher than 2019 levels. An obvious concern is that some of these estimates are an artifact of net oil price increases being correlated with other variables that explain recessions. The wsj shows this graph, linking oil price hikes to recessions:

Source: energyeconomist.com

Source: energyeconomist.com

Double that and that is the strike price for a recession. • as a result of the sharp swings in demand, oil. Year average closing price year open year. Oil prices caused the current recession that included this graphic from this publication of cibc world markets. Diane swonk, chief economist at grant thornton, estimates that the u.s.

Source: economicshelp.org

Source: economicshelp.org

Morgan economist peter mccrory noted in a recent report that every 10% increase in gas prices adds $4 billion in costs to consumers and every 10% increase in oil prices adds $19 billion. Mostly on how broad and deep the recession is. Energy news covering oil, petroleum, natural gas and investment advice In nominal terms, we see a fall from $126.33 in june 2008 to $31.04 in february 09 but by june 09 oil is back to $61.46 and by april of 2011 it was back to $102.15. Double that and that is the strike price for a recession.

Source: bloomberg.com

Source: bloomberg.com

Impacts of high oil prices on the economy. Diane swonk, chief economist at grant thornton, estimates that the u.s. The average price of wti crude oil was $57 per barrel in 2019 compared to $64 in 2018. The outlook for oil prices is driven largely by global economic growth, but it’s a. Jim bianco, president of bianco research, recently argued that “every 50% rise in crude [oil’s price] has led [to] a recession.” that’s a worrisome omen indeed, since oil’s.

Source: discourse.biologos.org

Source: discourse.biologos.org

Oil prices rose sharply before the. During the previous peak price back in 1979, the nominal monthly average oil price peaked at $38 per barrel (although the intraday prices spiked much higher). Oilprice.com, in cooperation with its partners, offers over 150 crude oil blends and indexes from all around the world, providing users with oil price charts, comparison tools. 53 rows oil prices in the 1960s and 1970s. The average price of wti crude oil was $57 per barrel in 2019 compared to $64 in 2018.

Source: energyeconomist.com

Source: energyeconomist.com

Energy news covering oil, petroleum, natural gas and investment advice The graph shown in the wsj is very familiar. Oil production, receding geopolitical concerns, and shifting opec policies. The graph shown in the wsj is very familiar. 53 rows oil prices in the 1960s and 1970s.

Source: seekingalpha.com

Source: seekingalpha.com

Oil prices caused the current recession that included this graphic from this publication of cibc world markets. The prospect of such a ban sent the price of brent crude to as high as $139.13 per barrel at one point overnight, the highest since july 2008, while the price of natural gas at one point on monday. Jeff rubin�s graphic showing connection of oil prices and recessions. For example, oil price shocks explain a 3 percent cumulative reduction in u.s. Diane swonk, chief economist at grant thornton, estimates that the u.s.

Source: dtn.com

Source: dtn.com

53 rows oil prices in the 1960s and 1970s. Slowdown would cause a global recession and oil demand would. Impacts of high oil prices on the economy. Crude oil is currently at $115. Jeff rubin�s graphic showing connection of oil prices and recessions.

You go through all those time frames, oil was up 90% or more, and in each of them we had a recession. On november 5, 2008, i wrote a post called jeff rubin: Global oil prices in the 20th century. Mostly on how broad and deep the recession is. Jim bianco, president of bianco research, recently argued that “every 50% rise in crude [oil’s price] has led [to] a recession.” that’s a worrisome omen indeed, since oil’s.

Source: energyeconomist.com

Source: energyeconomist.com

The graph shown in the wsj is very familiar. Historically, a surge in crude oil prices of this magnitude have ended us economic expansions and tipped america�s economy into recession, according to pictet asset management. Oil prices have increased significantly from their pandemic lows and are substantially higher than 2019 levels. Led to an accelerating rise in oil prices. A year ago, crude oil was $63.81 (march 4, 2021) a barrel.

Source: dupress.deloitte.com

Source: dupress.deloitte.com

Oil prices have increased significantly from their pandemic lows and are substantially higher than 2019 levels. The graph shown in the wsj is very familiar. Oil prices caused the current recession that included this graphic from this publication of cibc world markets. 53 rows oil prices in the 1960s and 1970s. According to a january 2020 eia report, the average price of brent crude oil in 2019 was $64 per barrel compared to $71 per barrel in 2018.

Source: dailyfx.com

Source: dailyfx.com

To what degree would a new recession affect oil prices? Crude oil prices & gas price charts. Jim bianco, president of bianco research, recently argued that “every 50% rise in crude [oil’s price] has led [to] a recession.” that’s a worrisome omen indeed, since oil’s. Real gdp in the late 1970s and early 1980s and a 5 percent cumulative reduction during the financial crisis. Led to an accelerating rise in oil prices.

Source: realeconomy.rsmus.com

Source: realeconomy.rsmus.com

Double that and that is the strike price for a recession. The average price of wti crude oil was $57 per barrel in 2019 compared to $64 in 2018. On november 5, 2008, i wrote a post called jeff rubin: Oil prices caused the current recession that included this graphic from this publication of cibc world markets. The graph shown in the wsj is very familiar.

Source: dailyfx.com

Source: dailyfx.com

Wall street journal graphic showing connection between oil price rise and recession. Wall street journal graphic showing connection between oil price rise and recession. 53 rows oil prices in the 1960s and 1970s. Oil prices have increased significantly from their pandemic lows and are substantially higher than 2019 levels. Energy news covering oil, petroleum, natural gas and investment advice

Source: dailyfx.com

Source: dailyfx.com

• as a result of the sharp swings in demand, oil. A year ago, crude oil was $63.81 (march 4, 2021) a barrel. Oil price charts for brent crude, wti & oil futures. Wall street journal graphic showing connection between oil price rise and recession. The prospect of such a ban sent the price of brent crude to as high as $139.13 per barrel at one point overnight, the highest since july 2008, while the price of natural gas at one point on monday.

Source: cnbc.com

Source: cnbc.com

To what degree would a new recession affect oil prices? The average price of wti crude oil was $57 per barrel in 2019 compared to $64 in 2018. To what degree would a new recession affect oil prices? On november 5, 2008, i wrote a post called jeff rubin: Year average closing price year open year.

Source: sharetisfy.com

Source: sharetisfy.com

Oilprice.com, in cooperation with its partners, offers over 150 crude oil blends and indexes from all around the world, providing users with oil price charts, comparison tools. Oil price charts for brent crude, wti & oil futures. Many others have produced versions of this chart which may vary from country to country. Wall street journal graphic showing connection between oil price rise and recession. In nominal terms, we see a fall from $126.33 in june 2008 to $31.04 in february 09 but by june 09 oil is back to $61.46 and by april of 2011 it was back to $102.15.

Source: ourfiniteworld.com

Source: ourfiniteworld.com

Jeff rubin�s graphic showing connection of oil prices and recessions. Oil prices caused the current recession that included this graphic from this publication of cibc world markets. Economy can weather six months of oil prices averaging around $100, although it could worsen the inflation problem, but a. Crude oil is currently at $115. Oil price charts for brent crude, wti & oil futures.

Source: energyeconomist.com

Source: energyeconomist.com

• as a result of the sharp swings in demand, oil. Oil production, receding geopolitical concerns, and shifting opec policies. On november 5, 2008, i wrote a post called jeff rubin: Led to an accelerating rise in oil prices. Oil prices caused the current recession that included this graphic from this publication of cibc world markets.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title oil prices and recession graph by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Man city vs man united player stats information

- Oil prices graph 2021 information

- Tottenham vs everton man of the match information

- Manchester city vs manchester united match today information

- International womens day 2022 facts information

- Iowa state basketball player xavier foster information

- Calvin ridley rookie year information

- Outlander season 6 hulu information

- Why is zion oil stock falling information

- Big ten basketball tournament printable bracket information