Oil prices during recession information

Home » Trend » Oil prices during recession informationYour Oil prices during recession images are available. Oil prices during recession are a topic that is being searched for and liked by netizens today. You can Download the Oil prices during recession files here. Get all free photos.

If you’re searching for oil prices during recession pictures information related to the oil prices during recession interest, you have pay a visit to the right site. Our website always provides you with suggestions for refferencing the maximum quality video and image content, please kindly surf and locate more enlightening video content and images that fit your interests.

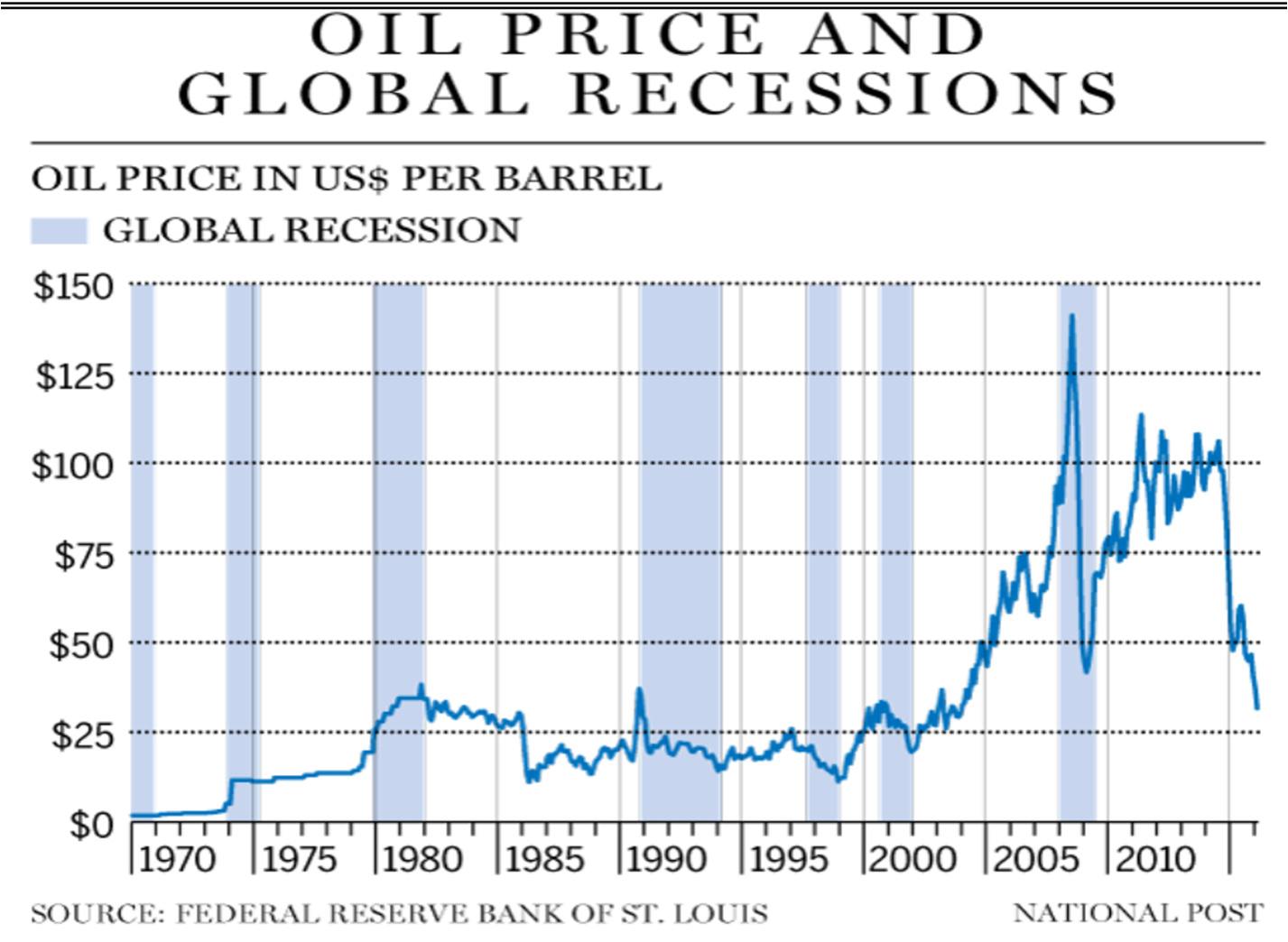

Oil Prices During Recession. Michael snyder is the author of the “beginning of the end” and runs a. Gold to oil price ratio spikes during times of recession, usually. Do oil prices rise during a recession? Real gdp growth is modelled.

Crude Oil Price Crushed to a 17Year Low as Global From dailyfx.com

Crude Oil Price Crushed to a 17Year Low as Global From dailyfx.com

It has been hard to keep up. Oil caused recession, not wall street. You go through all those time frames, oil was up 90% or more, and in each of them we had a recession. Do oil prices rise during a recession? Whereas linear models of the business cycle tend to assign low explanatory power to oil price fluctuations, some nonlinear models attribute a much larger role to oil prices. A lot left in the ground and a lot being produced.

Slowdown would cause a global recession and oil demand would drop by over 0.5 mbd a quarter, about half of what was.

The price of oil shown is adjusted for inflation using the headline cpi and is shown by default on a logarithmic scale. Ian wyatt may 15, 2009 at 00:00 commodities commodity prices. Price crashes usually happen because of weakening fundamentals, as in 1986 and 2014, a conflict between opec members over quota adherence, as in 1998, a recession as in 2008, or a pandemic. The price of crude reached $us145 in july 2008. The price of oil and world inflation and recession by michael r. The current month is updated on an hourly basis with today�s latest value.

Source: dailyfx.com

Source: dailyfx.com

The price of oil shown is adjusted for inflation using the headline cpi and is shown by default on a logarithmic scale. And eu are considering banning oil imports. It is the fact that high oil prices cause recession, and the fact that recession tends to causes oil prices to drop, that prevents oil prices from continuing to rise, in a. It has been hard to keep up. Increasing oil prices have been identified as a primary cause of recessions by hamilton (1983) as part of evidence linking them to an economic contraction of two or more consecutive quarters.

Source: dailyfx.com

Source: dailyfx.com

Adjusting for cpi inflation, that $40 in 1990 is the same as $85 today. You go through all those time frames, oil was up 90% or more, and in each of them we had a recession. Gold to oil price ratio spikes during times of recession, usually. Sanctions on russian energy could send oil prices above $125 per barrel which would almost certainly stall economic growth and lead to rising unemployment. New york (cnn business) crude oil prices briefly surged to their highest levels since 2008 thursday morning before pulling back a bit.

Source: bloomberg.com

Source: bloomberg.com

You go through all those time frames, oil was up 90% or more, and in each of them we had a recession. Is the oil price plunge a recession trigger? Gold to oil price ratio spikes during times of recession, usually. Increasing oil prices have been identified as a primary cause of recessions by hamilton (1983) as part of evidence linking them to an economic contraction of two or more consecutive quarters. The recession caused demand for energy to shrink in late 2008, with oil prices collapsing from the july 2008 high of $147 to a december 2008 low of $32.

Source: southfront.org

Source: southfront.org

It has been hard to keep up. New york (cnn business) crude oil prices briefly surged to their highest levels since 2008 thursday morning before pulling back a bit. Jim bianco, president of bianco research, recently argued that “every 50% rise in crude [oil’s price] has led [to] a recession.” that’s a worrisome omen indeed, since oil’s. It is the fact that high oil prices cause recession, and the fact that recession tends to causes oil prices to drop, that prevents oil prices from continuing to rise, in a. Oil caused recession, not wall street.

Mostly on how broad and deep the recession is. Oil prices are way up, in large part because of the war in ukraine and reports that the u.s. Few economists say the us is in danger of recession since the economy is underpinned by a. Both are climbing right now. By 2008, such pressures appeared to have an insignificant impact on oil prices given the onset of the global recession.

Source: espgtl.com

Source: espgtl.com

Has a recession, he said. Slowdown would cause a global recession and oil demand would drop by over 0.5 mbd a quarter, about half of what was. Is the oil price plunge a recession trigger? The current month is updated on an hourly basis with today�s latest value. How important the role of oil price shocks is in explaining recessions appears to depend largely on how their relationship with u.s.

Source: pragcap.com

Source: pragcap.com

You go through all those time frames, oil was up 90% or more, and in each of them we had a recession. The recession caused demand for energy to shrink in late 2008, with oil prices collapsing from the july 2008 high of $147 to a december 2008 low of $32. Adjusting for cpi inflation, that $40 in 1990 is the same as $85 today. New york (cnn business) crude oil prices briefly surged to their highest levels since 2008 thursday morning before pulling back a bit. You know over the course of the past few months i’ve not held wall street or the banking executives in high regard.

Source: ourfiniteworld.com

Source: ourfiniteworld.com

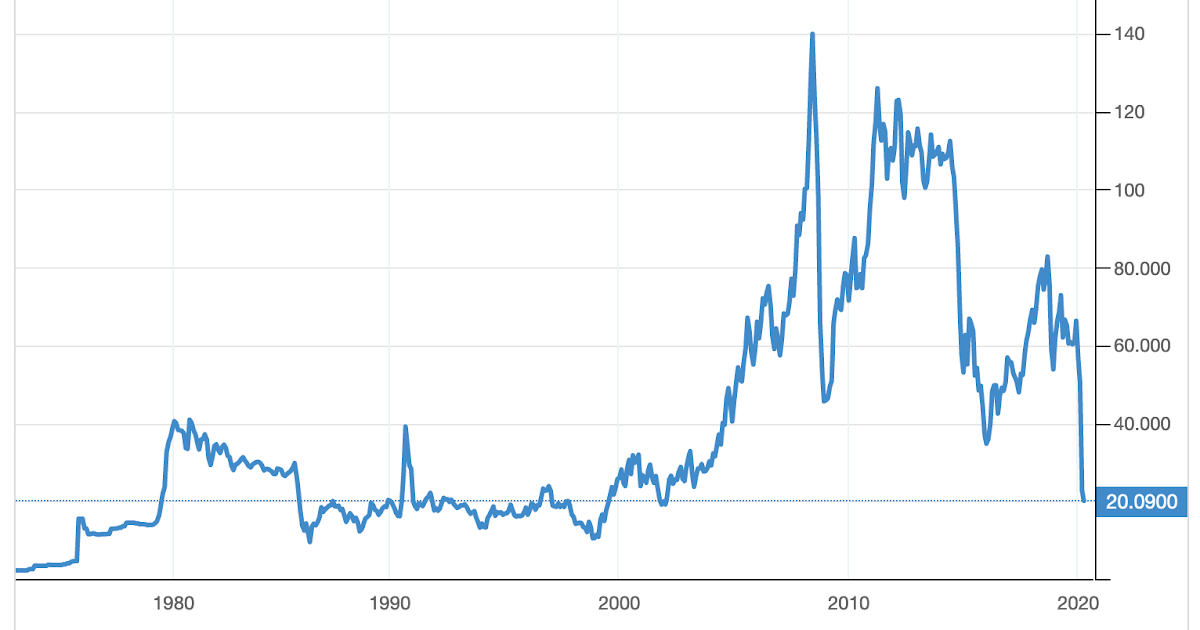

This more or less 70% drop marked a reversal in the steep upward trend in oil prices that had started in the early 2000s. A lot left in the ground and a lot being produced. Mostly on how broad and deep the recession is. Oil prices are way up, in large part because of the war in ukraine and reports that the u.s. Increasing oil prices have been identified as a primary cause of recessions by hamilton (1983) as part of evidence linking them to an economic contraction of two or more consecutive quarters.

Source: oilpricesgaikage.blogspot.com

Source: oilpricesgaikage.blogspot.com

The recession caused demand for energy to shrink in late 2008, with oil prices collapsing from the july 2008 high of $147 to a december 2008 low of $32. A lot left in the ground and a lot being produced. Few economists say the us is in danger of recession since the economy is underpinned by a. Jim bianco, president of bianco research, recently argued that “every 50% rise in crude [oil’s price] has led [to] a recession.” that’s a worrisome omen indeed, since oil’s. Adjusting for cpi inflation, that $40 in 1990 is the same as $85 today.

Source: davidstockmanscontracorner.com

Source: davidstockmanscontracorner.com

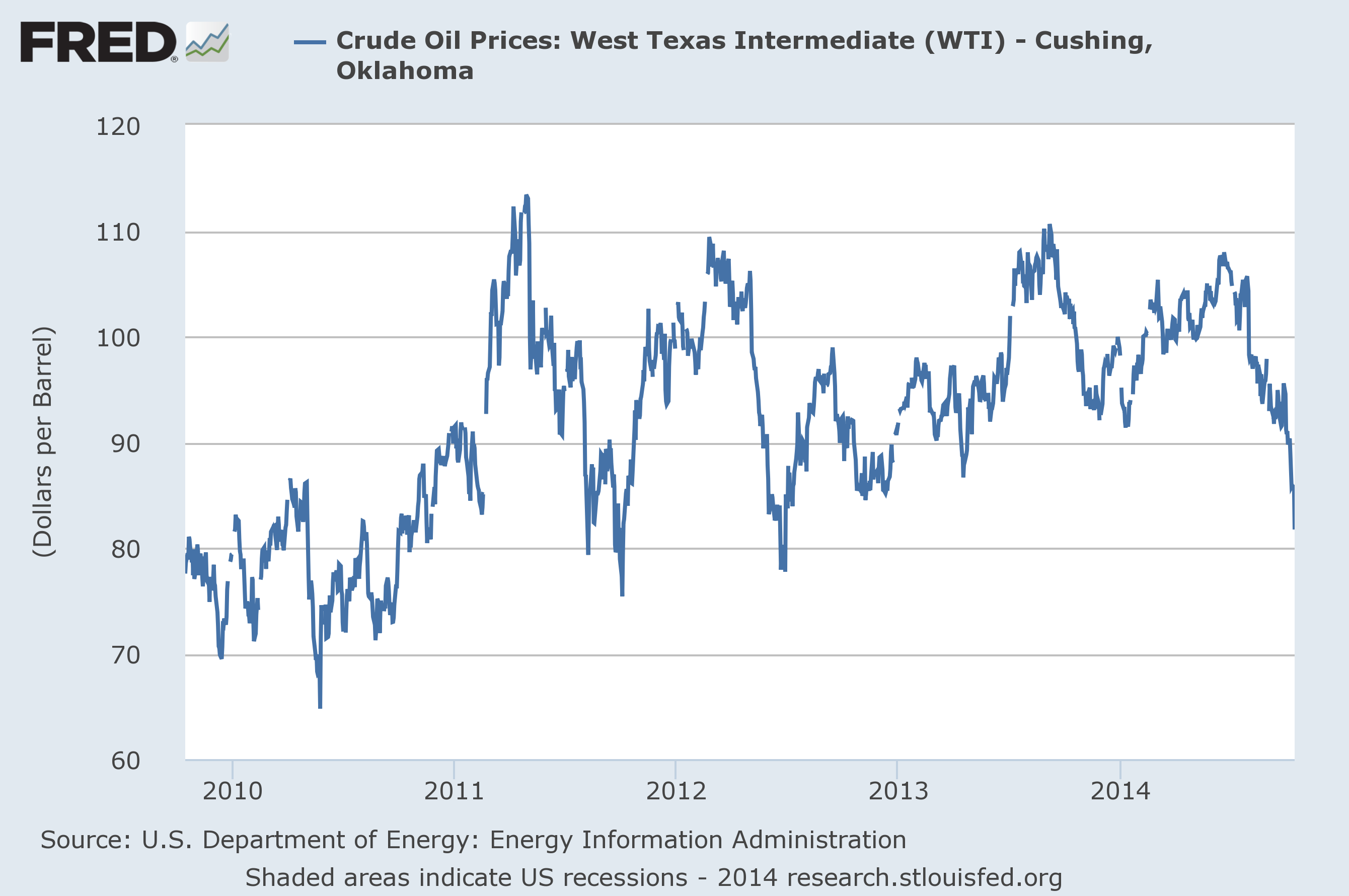

The price of oil and world inflation and recession by michael r. Amidst the turmoil of earthquake, tsunami, and nuclear meltdown in japan, the arab spring, war with libya and the assassination of osama bin laden, oil prices have also shot up from around $80 to >$120. Still, at about $110 a. Ian wyatt may 15, 2009 at 00:00 commodities commodity prices. And eu are considering banning oil imports.

Source: energyeconomist.com

Source: energyeconomist.com

The 2008 financial crisis and great recession induced a bear market in oil and gas, sending the price of a barrel of crude oil from $133.88 to $39.09 in just a less than a year. A lot left in the ground and a lot being produced. The 2008 financial crisis and great recession induced a bear market in oil and gas, sending the price of a barrel of crude oil from $133.88 to $39.09 in just a less than a year. Russia’s economy will suffer from the global recession and local efforts to contain the pandemic and the low price of oil—russia’s. It is the fact that high oil prices cause recession, and the fact that recession tends to causes oil prices to drop, that prevents oil prices from continuing to rise, in a.

Source: discourse.biologos.org

Source: discourse.biologos.org

You go through all those time frames, oil was up 90% or more, and in each of them we had a recession. It is the fact that high oil prices cause recession, and the fact that recession tends to causes oil prices to drop, that prevents oil prices from continuing to rise, in a. The current month is updated on an hourly basis with today�s latest value. Has a recession, he said. The current price of wti crude oil as of march 01, 2022 is.

Source: ourfiniteworld.com

Source: ourfiniteworld.com

A lot left in the ground and a lot being produced. Price crashes usually happen because of weakening fundamentals, as in 1986 and 2014, a conflict between opec members over quota adherence, as in 1998, a recession as in 2008, or a pandemic. Slowdown would cause a global recession and oil demand would drop by over 0.5 mbd a quarter, about half of what was. By 2008, such pressures appeared to have an insignificant impact on oil prices given the onset of the global recession. New york (cnn business) crude oil prices briefly surged to their highest levels since 2008 thursday morning before pulling back a bit.

Adjusting for cpi inflation, that $40 in 1990 is the same as $85 today. Few economists say the us is in danger of recession since the economy is underpinned by a. How important the role of oil price shocks is in explaining recessions appears to depend largely on how their relationship with u.s. A lot left in the ground and a lot being produced. At the same time, oil prices rose significantly mainly as a result of the increase in demand from china and india.

Source: drivebycuriosity.blogspot.com

Source: drivebycuriosity.blogspot.com

Rising oil and gas prices during a recession. The recession caused demand for energy to shrink in late 2008, with oil prices collapsing from the july 2008 high of $147 to a december 2008 low of $32. Whereas linear models of the business cycle tend to assign low explanatory power to oil price fluctuations, some nonlinear models attribute a much larger role to oil prices. Real gdp growth is modelled. Jim bianco, president of bianco research, recently argued that “every 50% rise in crude [oil’s price] has led [to] a recession.” that’s a worrisome omen indeed, since oil’s.

Source: econbrowser.com

Source: econbrowser.com

Several studies such as hamilton (2009) argued that sharp rise in oil prices contributed to the great recession. The price of oil and world inflation and recession by michael r. This more or less 70% drop marked a reversal in the steep upward trend in oil prices that had started in the early 2000s. There is a lot of oil about. Adjusting for cpi inflation, that $40 in 1990 is the same as $85 today.

Source: ourfiniteworld.com

Source: ourfiniteworld.com

This more or less 70% drop marked a reversal in the steep upward trend in oil prices that had started in the early 2000s. Thus far, oil is up 52% from 18 month low (with $92/barrel as the implied threshold) Real gdp growth is modelled. Michael snyder is the author of the “beginning of the end” and runs a. Global events have moved extremely fast during the first half of 2011.

Source: dailyfx.com

Source: dailyfx.com

Still, at about $110 a. Slowdown would cause a global recession and oil demand would drop by over 0.5 mbd a quarter, about half of what was. Whereas linear models of the business cycle tend to assign low explanatory power to oil price fluctuations, some nonlinear models attribute a much larger role to oil prices. A lot left in the ground and a lot being produced. It is the fact that high oil prices cause recession, and the fact that recession tends to causes oil prices to drop, that prevents oil prices from continuing to rise, in a.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title oil prices during recession by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Man city vs man united player stats information

- Oil prices graph 2021 information

- Tottenham vs everton man of the match information

- Manchester city vs manchester united match today information

- International womens day 2022 facts information

- Iowa state basketball player xavier foster information

- Calvin ridley rookie year information

- Outlander season 6 hulu information

- Why is zion oil stock falling information

- Big ten basketball tournament printable bracket information