Oil prices q3 2020 information

Home » Trending » Oil prices q3 2020 informationYour Oil prices q3 2020 images are available. Oil prices q3 2020 are a topic that is being searched for and liked by netizens today. You can Find and Download the Oil prices q3 2020 files here. Download all royalty-free photos and vectors.

If you’re looking for oil prices q3 2020 pictures information linked to the oil prices q3 2020 keyword, you have come to the ideal blog. Our site always gives you suggestions for viewing the maximum quality video and image content, please kindly surf and find more informative video content and images that fit your interests.

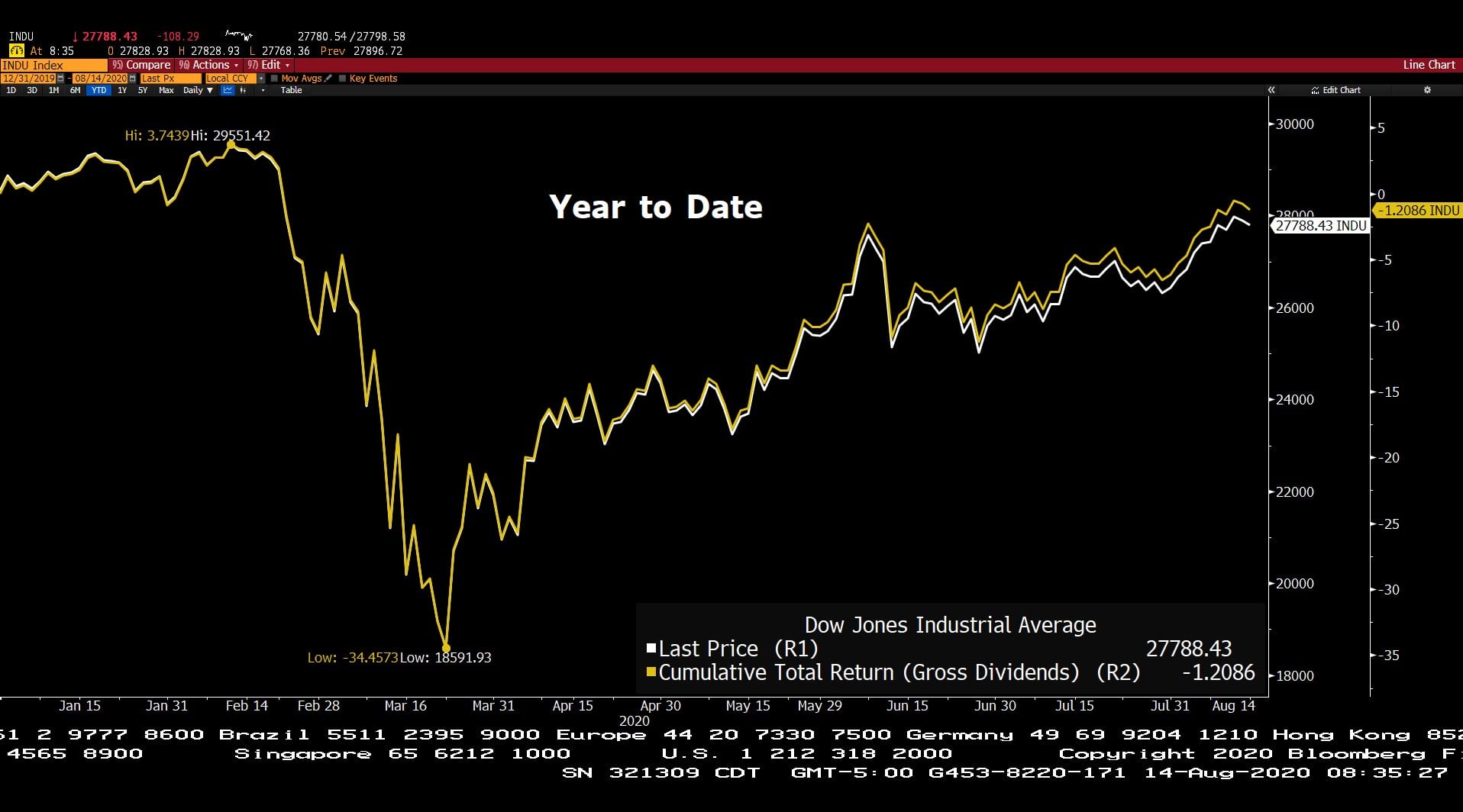

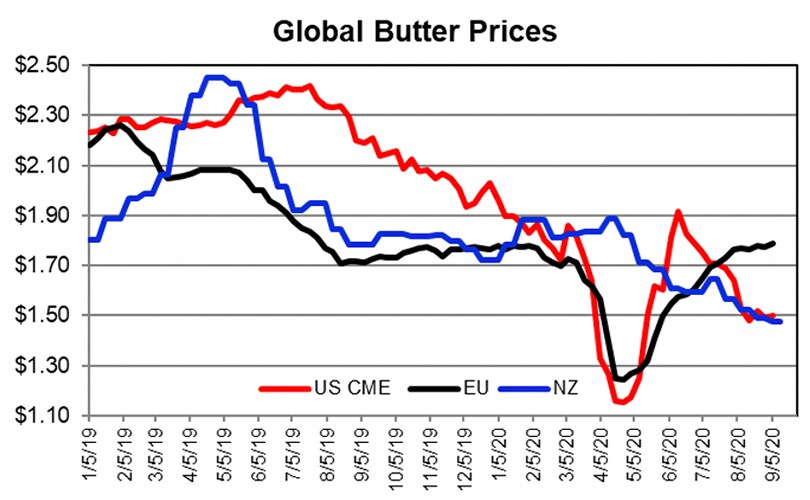

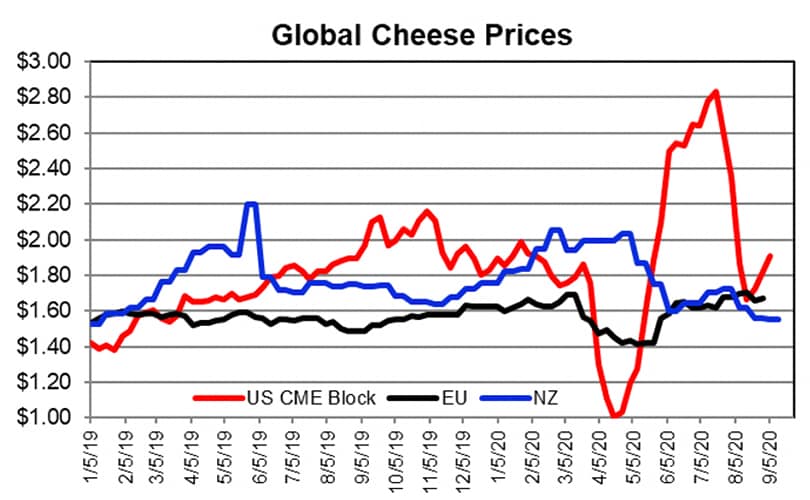

Oil Prices Q3 2020. Oil price and rig counts, the eia believes the rig count is likely to continue to increase in response to wti crude prices rising from less than $50 a. Wednesday, 15 apr 2020 05:44 pm myt. In the summer 2020, international spot prices recovered strongly after months of depression. Average pricing reflects strip commodity pricing as at nov.

Oil price hike revives petrochemical companies From dailynewsegypt.com

Oil price hike revives petrochemical companies From dailynewsegypt.com

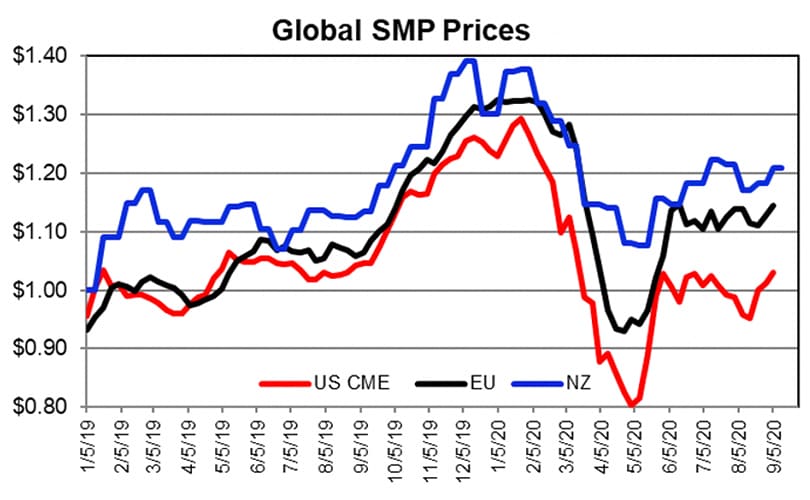

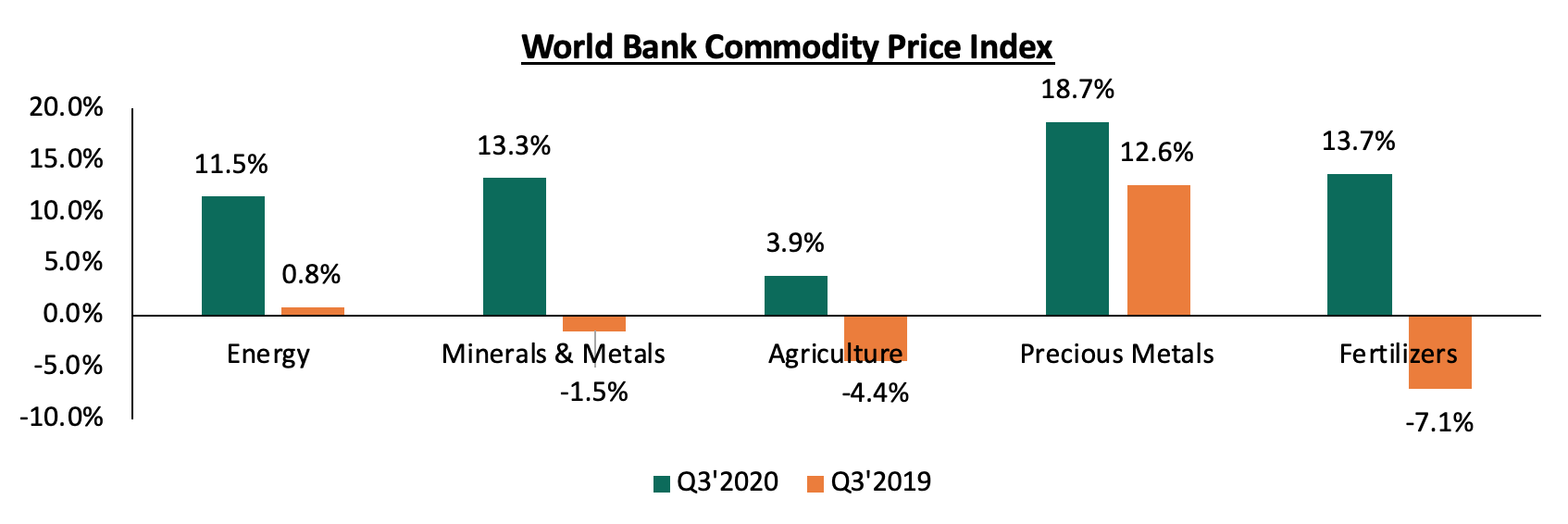

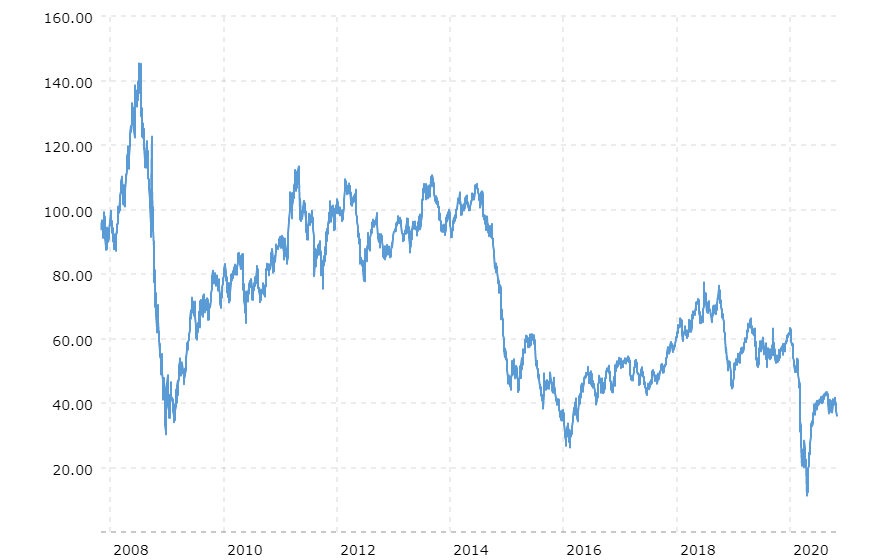

In september, european and asian spot prices were more than twice the level of june. Wednesday, 15 apr 2020 05:44 pm myt. Oil price and rig counts, the eia believes the rig count is likely to continue to increase in response to wti crude prices rising from less than $50 a. Prices may vary depending on your location. The commodity market performed relatively well in the third quarter, higher after the worst pandemic known to man disrupted financial markets at an unprecedented level. Global oil and gas market outlook • oil prices rebounded after the 2014 downturn, but capital expenditures never recovered from the peak and are now falling again, with an expectation of a further decline.

I don’t see oil prices recovering in the next 12 months and much of the sector is hoping $30s, and.

Overall, the iea sees global oil product demand returning to 2019 levels in 2022, despite a 1.3 million b/d lag in jet and kerosene demand from 2019 levels. By the end of 2021, the iea sees oil consumption reaching 99.1 million b/d, around 4.7 million b/d higher than at the end of 2020, but still 1.1 million b/d lower than at the end of 2019. 2, 2020 and does include upside pricing potential on collar instruments. In the summer 2020, international spot prices recovered strongly after months of depression. Octane 80 will stay at egp 6.5, octane 92 will be kept at egp 7.75 and octane 95 will remain at 8.75 as well as diesel at 6.75. 0.5% increase from $2.53 in q3 to $2.54 in q4.

Source: towardsdatascience.com

Source: towardsdatascience.com

That said the commodity market is made up of primary commodities like crude oil, cocoa, coffee, corn, hog, gold, silver, platinum, and. Average pricing reflects strip commodity pricing as at nov. A recent reuters poll suggests oil prices are unlikely to recover much more in 2021 due to a new. Q3 2020 results 4 during the third quarter of 2020, extra virgin olive oil prices increased by 8%, despite staying 2% below the prices of the previous corporate year. Upstream spending in 2020 will likely be almost 55% below the 2014 peak.

Source: dailynewsegypt.com

Source: dailynewsegypt.com

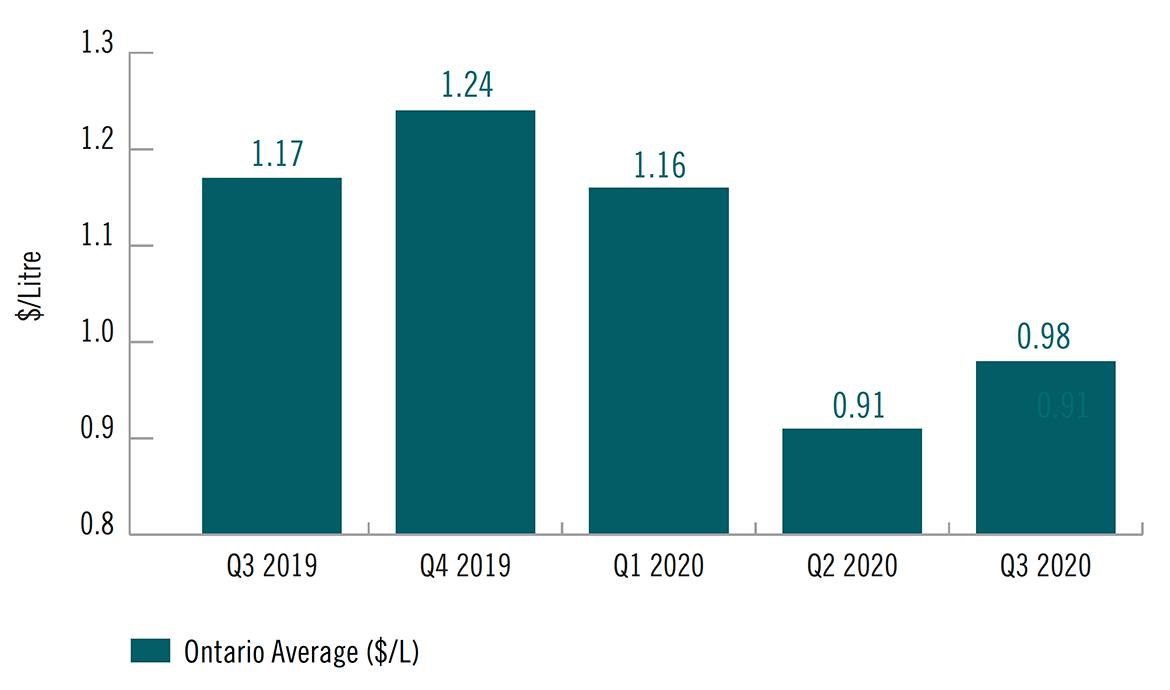

Octane 80 will stay at egp 6.5, octane 92 will be kept at egp 7.75 and octane 95 will remain at 8.75 as well as diesel at 6.75. Octane 80 will stay at egp 6.5, octane 92 will be kept at egp 7.75 and octane 95 will remain at 8.75 as well as diesel at 6.75. “oil prices have dropped 53 per cent since feb 24, so the recent action will likely send oil prices to move between us$30 and us$40 per barrel,” he told bernama. Toronto footnote 1 [1] regular unleaded gasoline retail prices in q3 2020 were 17.1 cents per litre (¢/l) lower than in q3 2019. Oil price and rig counts, the eia believes the rig count is likely to continue to increase in response to wti crude prices rising from less than $50 a.

Source: themcgowangroup.com

Source: themcgowangroup.com

Morgan stanley raises its q3 oil price forecast. Cents for the third quarter of 2020. The commodity market performed relatively well in the third quarter, higher after the worst pandemic known to man disrupted financial markets at an unprecedented level. Upstream spending in 2020 will likely be almost 55% below the 2014 peak. Prices may vary depending on your location.

Source: forbes.com

Source: forbes.com

Best performing commodities in q3, 2020. Economic recovery to boost crude oil demand in q3 2020. By contrast, q3 2020 global supply was down by 9.7 million barrels per day compared with one year ago with cuts led by opec nations eia expects the global oil market to rebalance in q3 2020 and support oil prices Average pricing reflects strip commodity pricing as at nov. The adjusted net loss was $219 million, or.

Source: investingcube.com

Source: investingcube.com

Octane 80 will stay at egp 6.5, octane 92 will be kept at egp 7.75 and octane 95 will remain at 8.75 as well as diesel at 6.75. Average pricing reflects strip commodity pricing as at nov. I don’t see oil prices recovering in the next 12 months and much of the sector is hoping $30s, and. Wednesday, 15 apr 2020 05:44 pm myt. Best performing commodities in q3, 2020.

Source: americaninvestmentreport.com

Source: americaninvestmentreport.com

Global oil and gas market outlook • oil prices rebounded after the 2014 downturn, but capital expenditures never recovered from the peak and are now falling again, with an expectation of a further decline. Egypt’s fuel automatic pricing committee decided to keep the current fuel prices the same for q3 2020, which will stabilize the local markets, according to a press release. Wednesday, 15 apr 2020 05:44 pm myt. Average pricing reflects strip commodity pricing as at nov. Oil price and rig counts, the eia believes the rig count is likely to continue to increase in response to wti crude prices rising from less than $50 a.

Source: themcgowangroup.com

Source: themcgowangroup.com

In september, european and asian spot prices were more than twice the level of june. Oil has recovered from record lows but $40 prices unlikely before q3 2020. Oil price and rig counts, the eia believes the rig count is likely to continue to increase in response to wti crude prices rising from less than $50 a. In september, european and asian spot prices were more than twice the level of june. In the summer 2020, international spot prices recovered strongly after months of depression.

Source: trendtradingdna.com

Source: trendtradingdna.com

Details of hedging contracts provided in the q3 2020 md&a. 0.5% increase from $2.53 in q3 to $2.54 in q4. Morgan stanley raises its q3 oil price forecast. Oil price and rig counts, the eia believes the rig count is likely to continue to increase in response to wti crude prices rising from less than $50 a. Details of hedging contracts provided in the q3 2020 md&a.

Source: westwoodenergy.com

Source: westwoodenergy.com

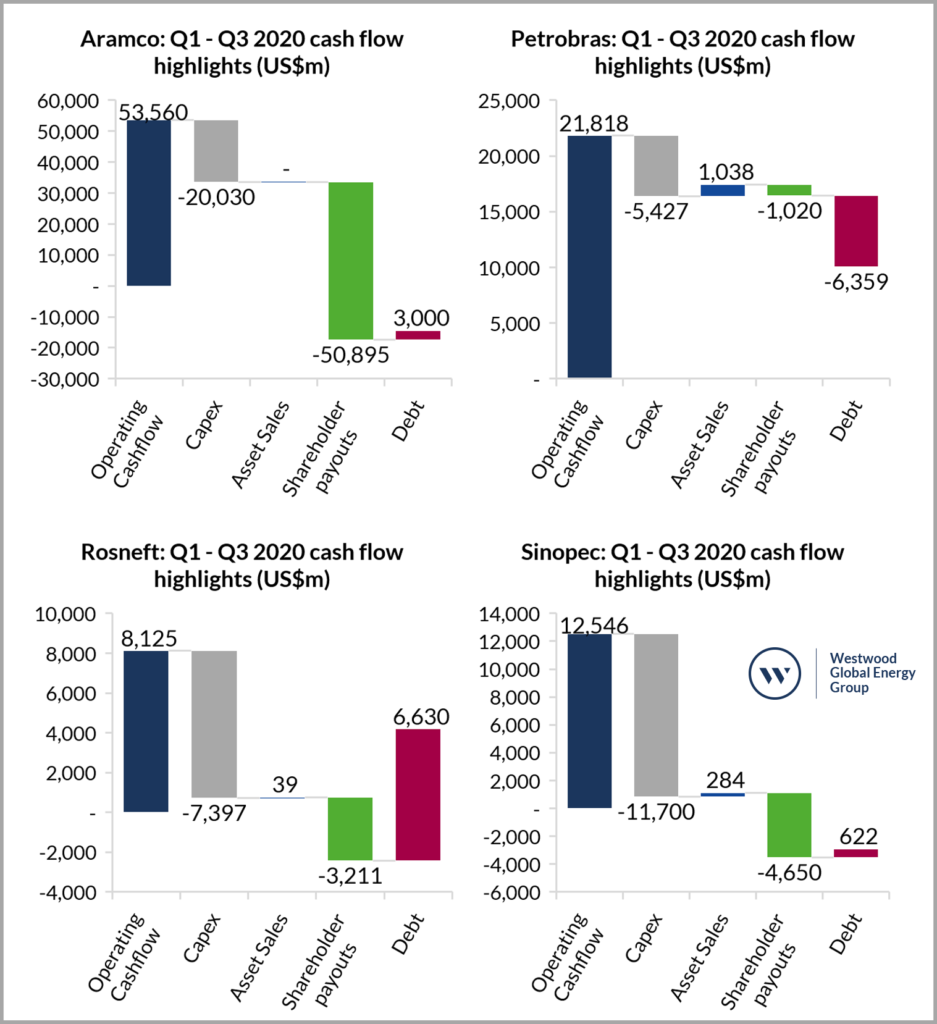

Wednesday, 15 apr 2020 05:44 pm myt. Capex and opex cuts are already in public domain and projects will be delayed for much of 2020. However, fears about virus resurgence have Egypt’s fuel automatic pricing committee decided to keep the current fuel prices the same for q3 2020, which will stabilize the local markets, according to a press release. Global oil and gas market outlook • oil prices rebounded after the 2014 downturn, but capital expenditures never recovered from the peak and are now falling again, with an expectation of a further decline.

Source: cmegroup.com

Source: cmegroup.com

2, 2020 and does include upside pricing potential on collar instruments. 0.5% increase from $2.53 in q3 to $2.54 in q4. Prices may vary depending on your location. 2, 2020 and does include upside pricing potential on collar instruments. 2, 2020 and does include upside pricing potential on collar instruments.

Source: brandspurng.com

Source: brandspurng.com

Shell said it would raise its dividend to shareholders by around 4% to 16.65 u.s. Overall, the iea sees global oil product demand returning to 2019 levels in 2022, despite a 1.3 million b/d lag in jet and kerosene demand from 2019 levels. This unexpected bullish run was mainly due to a supply cutback as global lng supply reduced more than. By the end of 2021, the iea sees oil consumption reaching 99.1 million b/d, around 4.7 million b/d higher than at the end of 2020, but still 1.1 million b/d lower than at the end of 2019. Operating cash flows for the quarter totaled us$32.2b, nearly three times the q2 level but still 36% lower than a year prior.

Source: cmegroup.com

Source: cmegroup.com

By the end of 2021, the iea sees oil consumption reaching 99.1 million b/d, around 4.7 million b/d higher than at the end of 2020, but still 1.1 million b/d lower than at the end of 2019. 2, 2020 and does include upside pricing potential on collar instruments. Wti hedges include a combination of fixed price swaps, collars, and 3‐way contracts. Average pricing reflects strip commodity pricing as at nov. Get a free detailed estimate for an oil change in your area from kbb.com

Source: stcatharinesstandard.ca

Source: stcatharinesstandard.ca

By the end of 2021, the iea sees oil consumption reaching 99.1 million b/d, around 4.7 million b/d higher than at the end of 2020, but still 1.1 million b/d lower than at the end of 2019. The average price of a 2020 audi q3 oil change can vary depending on location. However, fears about virus resurgence have Upstream spending in 2020 will likely be almost 55% below the 2014 peak. The adjusted net loss was $219 million, or.

Source: cmegroup.com

Source: cmegroup.com

Capex and opex cuts are already in public domain and projects will be delayed for much of 2020. By the end of 2021, the iea sees oil consumption reaching 99.1 million b/d, around 4.7 million b/d higher than at the end of 2020, but still 1.1 million b/d lower than at the end of 2019. Best performing commodities in q3, 2020. Upstream spending in 2020 will likely be almost 55% below the 2014 peak. Global oil and gas market outlook • oil prices rebounded after the 2014 downturn, but capital expenditures never recovered from the peak and are now falling again, with an expectation of a further decline.

Source: cytonnreport.com

Source: cytonnreport.com

Global oil and gas market outlook • oil prices rebounded after the 2014 downturn, but capital expenditures never recovered from the peak and are now falling again, with an expectation of a further decline. Cents for the third quarter of 2020. Details of hedging contracts provided in the q3 2020 md&a. In the summer 2020, international spot prices recovered strongly after months of depression. By contrast, q3 2020 global supply was down by 9.7 million barrels per day compared with one year ago with cuts led by opec nations eia expects the global oil market to rebalance in q3 2020 and support oil prices

Source: newsfilter.io

Source: newsfilter.io

By the end of 2021, the iea sees oil consumption reaching 99.1 million b/d, around 4.7 million b/d higher than at the end of 2020, but still 1.1 million b/d lower than at the end of 2019. A recent reuters poll suggests oil prices are unlikely to recover much more in 2021 due to a new. 2, 2020 and does include upside pricing potential on collar instruments. By the end of 2021, the iea sees oil consumption reaching 99.1 million b/d, around 4.7 million b/d higher than at the end of 2020, but still 1.1 million b/d lower than at the end of 2019. Upstream spending in 2020 will likely be almost 55% below the 2014 peak.

Source: ontario.ca

Source: ontario.ca

Overall, the iea sees global oil product demand returning to 2019 levels in 2022, despite a 1.3 million b/d lag in jet and kerosene demand from 2019 levels. Global oil and gas market outlook • oil prices rebounded after the 2014 downturn, but capital expenditures never recovered from the peak and are now falling again, with an expectation of a further decline. The average price of a 2020 audi q3 oil change can vary depending on location. Average pricing reflects strip commodity pricing as at nov. 2, 2020 and does include upside pricing potential on collar instruments.

Source: cmegroup.com

Source: cmegroup.com

2, 2020 and does include upside pricing potential on collar instruments. Capex and opex cuts are already in public domain and projects will be delayed for much of 2020. “oil prices have dropped 53 per cent since feb 24, so the recent action will likely send oil prices to move between us$30 and us$40 per barrel,” he told bernama. Q3 2020 results 4 during the third quarter of 2020, extra virgin olive oil prices increased by 8%, despite staying 2% below the prices of the previous corporate year. Shell said it would raise its dividend to shareholders by around 4% to 16.65 u.s.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title oil prices q3 2020 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Manchester united home jersey information

- Manchester united long sleeve jersey information

- Big 10 tournament bracket results information

- Lil bo weep forever lyrics information

- International womens day 2022 ukraine information

- Iowa vs xavier basketball information

- Outlander knitting patterns free information

- Tottenham vs everton tv us information

- International womens day disney information

- Bill cosby victoria valentino information