Oil prices vs inflation chart information

Home » Trend » Oil prices vs inflation chart informationYour Oil prices vs inflation chart images are ready. Oil prices vs inflation chart are a topic that is being searched for and liked by netizens now. You can Find and Download the Oil prices vs inflation chart files here. Get all royalty-free vectors.

If you’re searching for oil prices vs inflation chart images information linked to the oil prices vs inflation chart interest, you have visit the ideal blog. Our website always gives you hints for downloading the highest quality video and image content, please kindly search and find more informative video articles and graphics that match your interests.

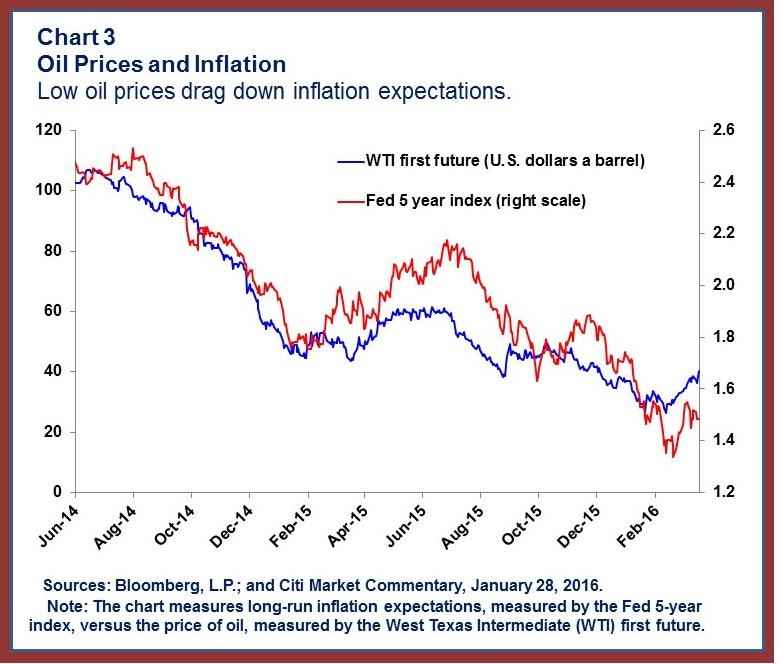

Oil Prices Vs Inflation Chart. The impact of rising crude oil prices on wpi and cpi inflation in fy2017 would be influenced by the extent of pass through to domestic retail prices of fuels and the degree to which the earlier excise hikes on petrol and diesel are reversed. Prices tend to rise more rapidly when there is less excess capacity and unemployment. What is this this chart shows 🟢 the absolute price (like the price you see in the real world) vs. Countries from japan to the united states discussed banning.

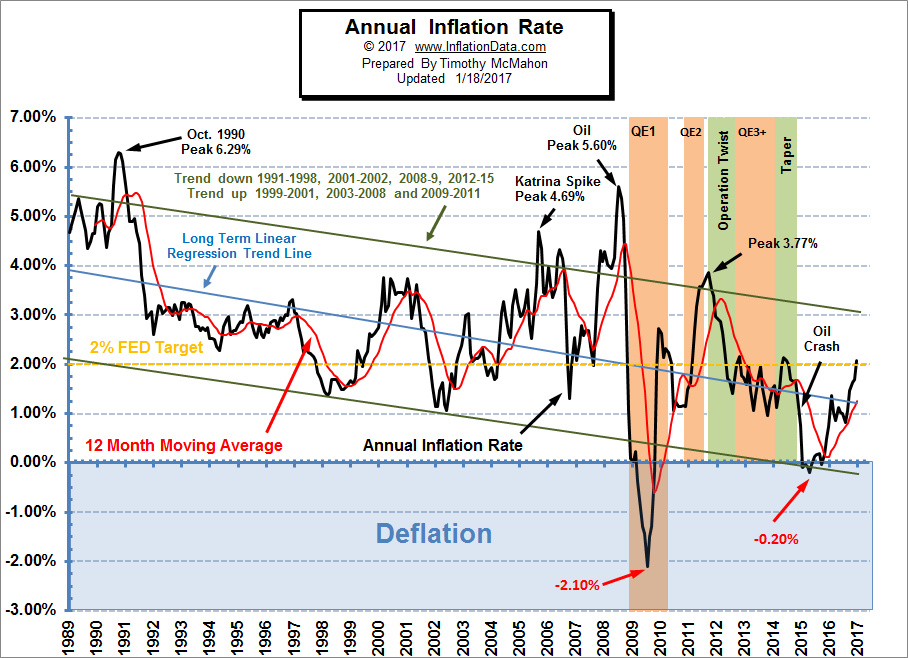

Annual Inflation Chart From inflationdata.com

Annual Inflation Chart From inflationdata.com

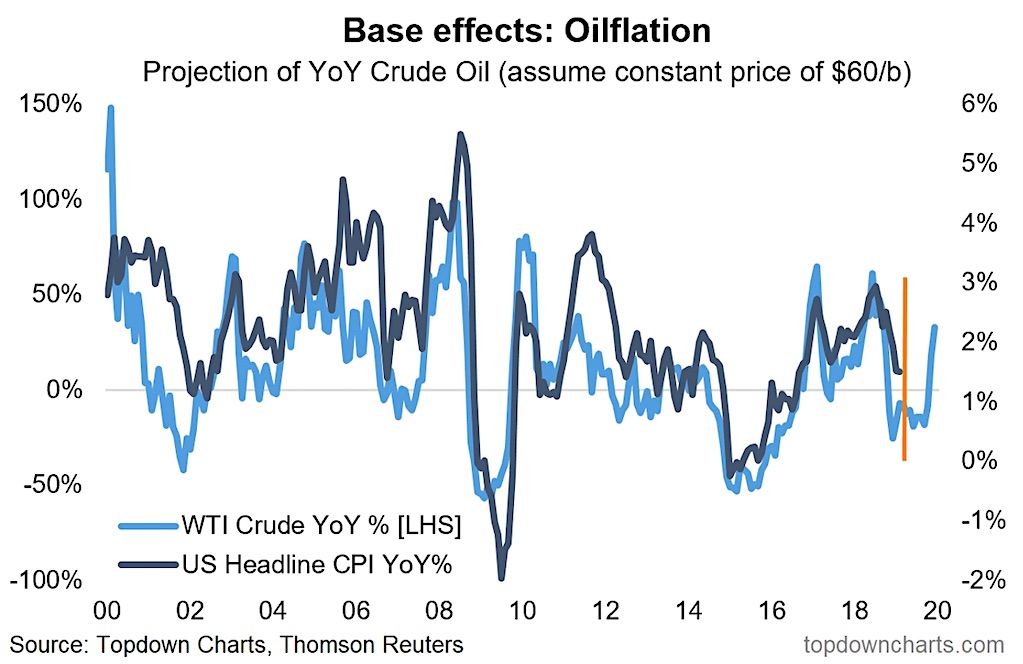

The key point is that the huge increase in prices in 2021 will gradually drop out of the annual comparison this year, meaning that in the absence of an even larger jump in oil and gas prices in 2022, energy inflation should drop back. Stock index futures slid on monday, with banks and travel stocks falling the most as the prospect of a ban on oil imports from russia pushed brent to over $130 a barrel and added to concerns over spiraling inflation and slowing economic growth. A 10 percent increase in global oil inflation. F or example, the 2008 and 2011 oil price spikes were driven by the large declines in real yield. Price day month year date; Eight of the 11 major s&p sectors were lower, with financial (.spsy) and technology (.splrct) sliding 2%.

The impact of rising crude oil prices on wpi and cpi inflation in fy2017 would be influenced by the extent of pass through to domestic retail prices of fuels and the degree to which the earlier excise hikes on petrol and diesel are reversed.

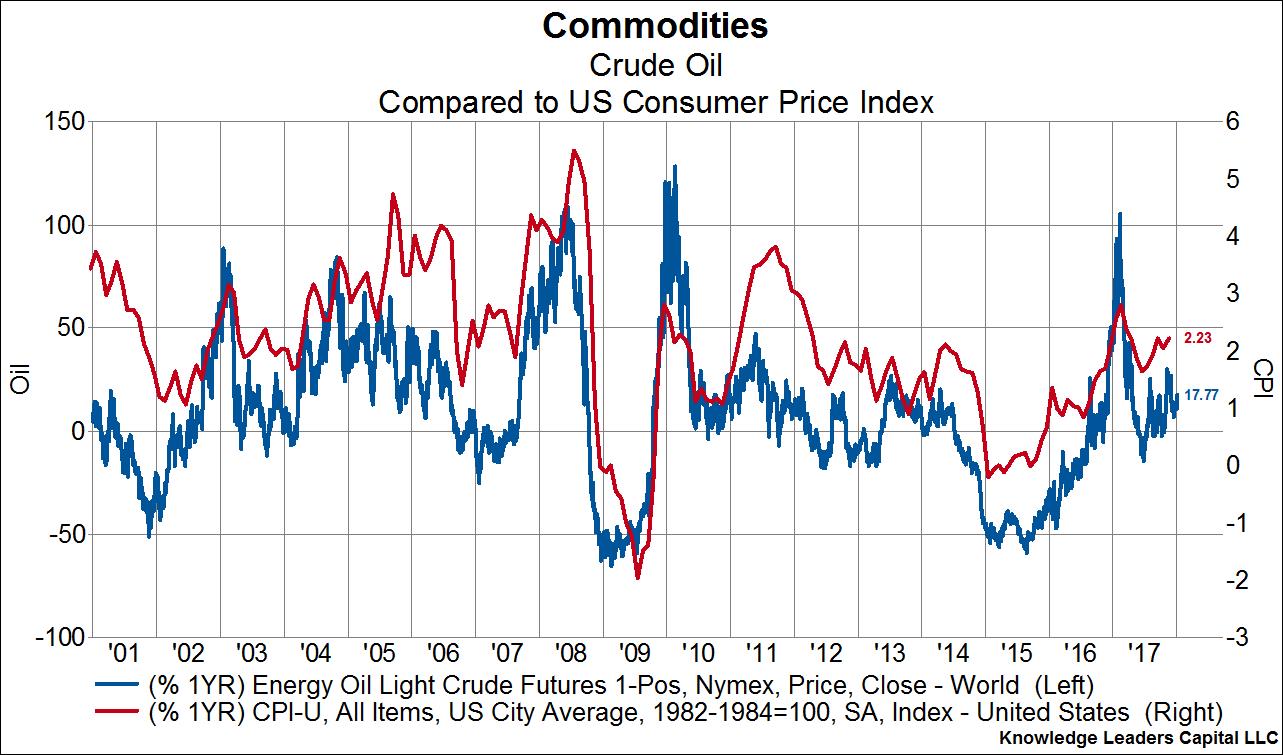

Thus, a government can fight a burst in inflation by adopting more restrictive policies that limit economic activity and induce greater unemployment. This interactive chart compares the daily price performance of west texas intermediate (wti) or nymex crude oil vs regular gasoline prices, u.s. In contrast, the graph shows a positive but much weaker relationship between oil prices and cpi inflation: If, say, half the prices of consumer goods increase (in terms of the other half), it means that the other 50% of prices have decreased (in terms of. At that point, you could have exchanged your 100 barrels for $9148 and bought 10.49 ounces of gold. This resulted in crude prices surging to levels not seen since 2008, while the national gasoline average topped $4 a gallon, according to aaa.

Source: inflationdata.com

The current national average price is $3.78 for fuel oil #2 per gallon (3.785 liters). For the coming week, inflation data, bond yields and oil prices are likely to influence market action. Year average closing price year open year. This strong link likely comes from the importance of oil as an input in the production of goods. This resulted in crude prices surging to levels not seen since 2008, while the national gasoline average topped $4 a gallon, according to aaa.

Source: researchgate.net

Source: researchgate.net

At that point, you could have exchanged your 100 barrels for $9148 and bought 10.49 ounces of gold. Also explained by chart 1: Countries from japan to the united states discussed banning. Gulf coast over the last 10 years. India, which meets nearly 80% of its needs through oil imports, is worried about the rising crude oil prices as it could widen its oil import.

Source: inflationdata.com

Source: inflationdata.com

They tend to rise and fall in. These assumptions allow us to quantify the response of the three model variables to a surprise increase in the price of gasoline at the pump. In this perspective, an increase in the price of crude oil appears to increase inflation through the reduced supply of the many consumer goods using oil as an input. Thus, a government can fight a burst in inflation by adopting more restrictive policies that limit economic activity and induce greater unemployment. This data is collected by a national survey and can vary from region to region.

Oilprice.com, in cooperation with its partners, offers over 150 crude oil blends and indexes from all around the world, providing users with oil price charts, comparison tools. Specifically, the correlation between oil prices and the ppi is 0.71. Price day month year date; Inflation to overshoot rbi target on oil price spurt; F or example, the 2008 and 2011 oil price spikes were driven by the large declines in real yield.

Source: blog.knowledgeleaderscapital.com

Source: blog.knowledgeleaderscapital.com

But as we can see from the chart gas and oil prices are fairly closely related. Nevertheless, the impact would be relatively muted in cpi inflation as compared to wpi inflation. Based on this chart at 24 barrels to an ounce of gold, oil was cheaper. Oil prices eased early on friday as hot u.s. Panel of 72 advanced and developing economies over the period from 1970 to 2015.

Source: inflationdata.com

Source: inflationdata.com

At 7 am et, u.s. Price day month year date; But as we can see from the chart gas and oil prices are fairly closely related. Some explicit consideration before we discuss estimates of the impact of oil prices on inflation. This chart suggests that current global demand expectations have leading information regarding the acceleration of global cpi inflation over the next six months.

Source: federalreserve.gov

Source: federalreserve.gov

Year average closing price year open year. This strong link likely comes from the importance of oil as an input in the production of goods. A 10 percent increase in global oil inflation. Countries from japan to the united states discussed banning. India, which meets nearly 80% of its needs through oil imports, is worried about the rising crude oil prices as it could widen its oil import.

Source: inflationdata.com

Source: inflationdata.com

By using the average annual price we eliminate brief spikes and get a better picture of what we really pay over the long term. Stocks were set to open lower on monday as the prospect of a ban on oil imports from russia pushed brent above $130 a barrel and added to concerns over spiraling inflation and slowing economic growth. Fy23 projection between 4.7% and 5.2% russia’s invasion on ukraine on thursday. These assumptions allow us to quantify the response of the three model variables to a surprise increase in the price of gasoline at the pump. Also explained by chart 1:

Source: acting-man.com

Source: acting-man.com

Some explicit consideration before we discuss estimates of the impact of oil prices on inflation. In contrast, the graph shows a positive but much weaker relationship between oil prices and cpi inflation: Stock indexes tumbled more than 1% on monday as the prospect of a ban on oil imports from russia sent crude prices soaring and fueled concerns about spiraling inflation. Based on this chart at 24 barrels to an ounce of gold, oil was cheaper. Fy23 projection between 4.7% and 5.2% russia’s invasion on ukraine on thursday.

Source: seeitmarket.com

Source: seeitmarket.com

For the coming week, inflation data, bond yields and oil prices are likely to influence market action. The impact of rising crude oil prices on wpi and cpi inflation in fy2017 would be influenced by the extent of pass through to domestic retail prices of fuels and the degree to which the earlier excise hikes on petrol and diesel are reversed. They tend to rise and fall in. Stock indexes tumbled more than 1% on monday as the prospect of a ban on oil imports from russia sent crude prices soaring and fueled concerns about spiraling inflation. In this perspective, an increase in the price of crude oil appears to increase inflation through the reduced supply of the many consumer goods using oil as an input.

Source: acemaxx-analytics-dispinar.blogspot.com

Source: acemaxx-analytics-dispinar.blogspot.com

At that point, you could have exchanged your 100 barrels for $9148 and bought 10.49 ounces of gold. The correlation is 0.27, much lower than for producer prices. They tend to rise and fall in. Gulf coast over the last 10 years. These assumptions allow us to quantify the response of the three model variables to a surprise increase in the price of gasoline at the pump.

Source: inflationdata.com

Source: inflationdata.com

This interactive chart compares the daily price performance of west texas intermediate (wti) or nymex crude oil vs regular gasoline prices, u.s. In the chart below we see the correlation between the average annual price of regular gasoline and the average annual price of crude oil. The key point is that the huge increase in prices in 2021 will gradually drop out of the annual comparison this year, meaning that in the absence of an even larger jump in oil and gas prices in 2022, energy inflation should drop back. Some in the face of declining. They tend to rise and fall in.

Source: researchgate.net

Source: researchgate.net

Also explained by chart 1: Oil prices eased early on friday as hot u.s. At 7 am et, u.s. A 10 percent increase in global oil inflation. This resulted in crude prices surging to levels not seen since 2008, while the national gasoline average topped $4 a gallon, according to aaa.

Source: zerohedge.com

Source: zerohedge.com

The correlation is 0.27, much lower than for producer prices. They tend to rise and fall in. At that point, you could have exchanged your 100 barrels for $9148 and bought 10.49 ounces of gold. Bureau of labor statistics, prices for fuel oil are 6,301.15% higher in 2022 versus 1935 (a $238.18 difference in value). For the coming week, inflation data, bond yields and oil prices are likely to influence market action.

Source: fintrend.com

Source: fintrend.com

Bp kicks off a flurry of oil industry reports. The impact of rising crude oil prices on wpi and cpi inflation in fy2017 would be influenced by the extent of pass through to domestic retail prices of fuels and the degree to which the earlier excise hikes on petrol and diesel are reversed. We study the impact of fluctuations in global oil prices on domestic inflation using an unbalanced. But as we can see from the chart gas and oil prices are fairly closely related. The correlation is 0.27, much lower than for producer prices.

Source: inflationdata.com

Source: inflationdata.com

Year average closing price year open year. Stocks were set to open lower on monday as the prospect of a ban on oil imports from russia pushed brent above $130 a barrel and added to concerns over spiraling inflation and slowing economic growth. Thus, a government can fight a burst in inflation by adopting more restrictive policies that limit economic activity and induce greater unemployment. Eight of the 11 major s&p sectors were lower, with financial (.spsy) and technology (.splrct) sliding 2%. Bureau of labor statistics, prices for fuel oil are 6,301.15% higher in 2022 versus 1935 (a $238.18 difference in value).

Source: bmg-group.com

Source: bmg-group.com

Price day month year date; Thus, a government can fight a burst in inflation by adopting more restrictive policies that limit economic activity and induce greater unemployment. In the chart below we see the correlation between the average annual price of regular gasoline and the average annual price of crude oil. Some explicit consideration before we discuss estimates of the impact of oil prices on inflation. Oil prices eased early on friday as hot u.s.

Source: fintrend.com

Source: fintrend.com

Stocks were set to open lower on monday as the prospect of a ban on oil imports from russia pushed brent above $130 a barrel and added to concerns over spiraling inflation and slowing economic growth. The correlation is 0.27, much lower than for producer prices. Gulf coast over the last 10 years. Bureau of labor statistics, prices for fuel oil are 6,301.15% higher in 2022 versus 1935 (a $238.18 difference in value). Also explained by chart 1:

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title oil prices vs inflation chart by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Man city vs man united player stats information

- Oil prices graph 2021 information

- Tottenham vs everton man of the match information

- Manchester city vs manchester united match today information

- International womens day 2022 facts information

- Iowa state basketball player xavier foster information

- Calvin ridley rookie year information

- Outlander season 6 hulu information

- Why is zion oil stock falling information

- Big ten basketball tournament printable bracket information