Oil prices vs stock market information

Home » Trend » Oil prices vs stock market informationYour Oil prices vs stock market images are ready. Oil prices vs stock market are a topic that is being searched for and liked by netizens now. You can Get the Oil prices vs stock market files here. Get all royalty-free images.

If you’re looking for oil prices vs stock market pictures information connected with to the oil prices vs stock market interest, you have come to the right blog. Our website always gives you suggestions for seeking the highest quality video and image content, please kindly hunt and find more informative video content and images that match your interests.

Oil Prices Vs Stock Market. The risk and uncertainties associated with oil price unpredictability also upset investor’s portfolios, mainly. Ad access to the world’s most active equity securities through a single provider.. Crude oil vs the s&p 500. Our journey begins by reviewing theoretical transmission mechanisms between oil and stock market performance, highlighting five different channels:

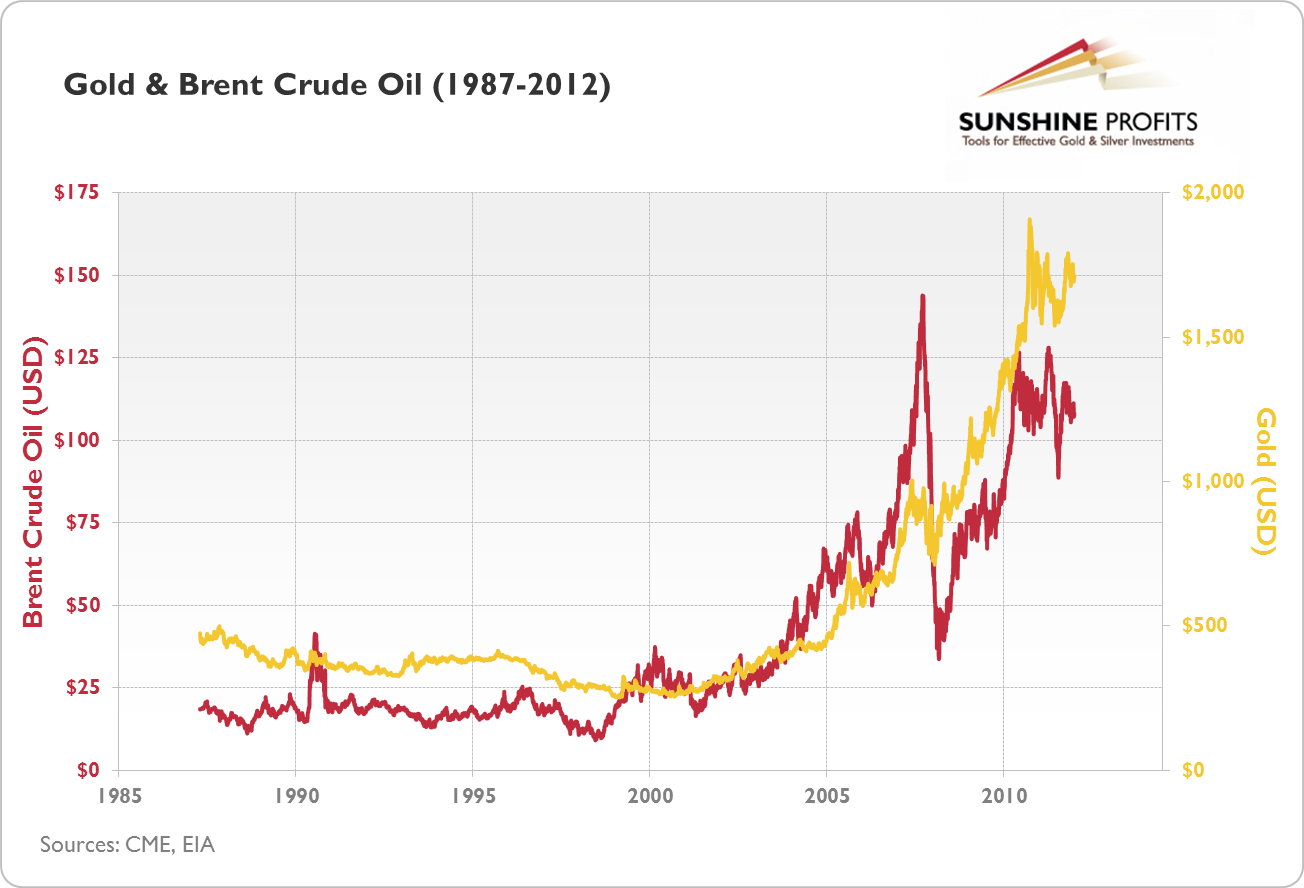

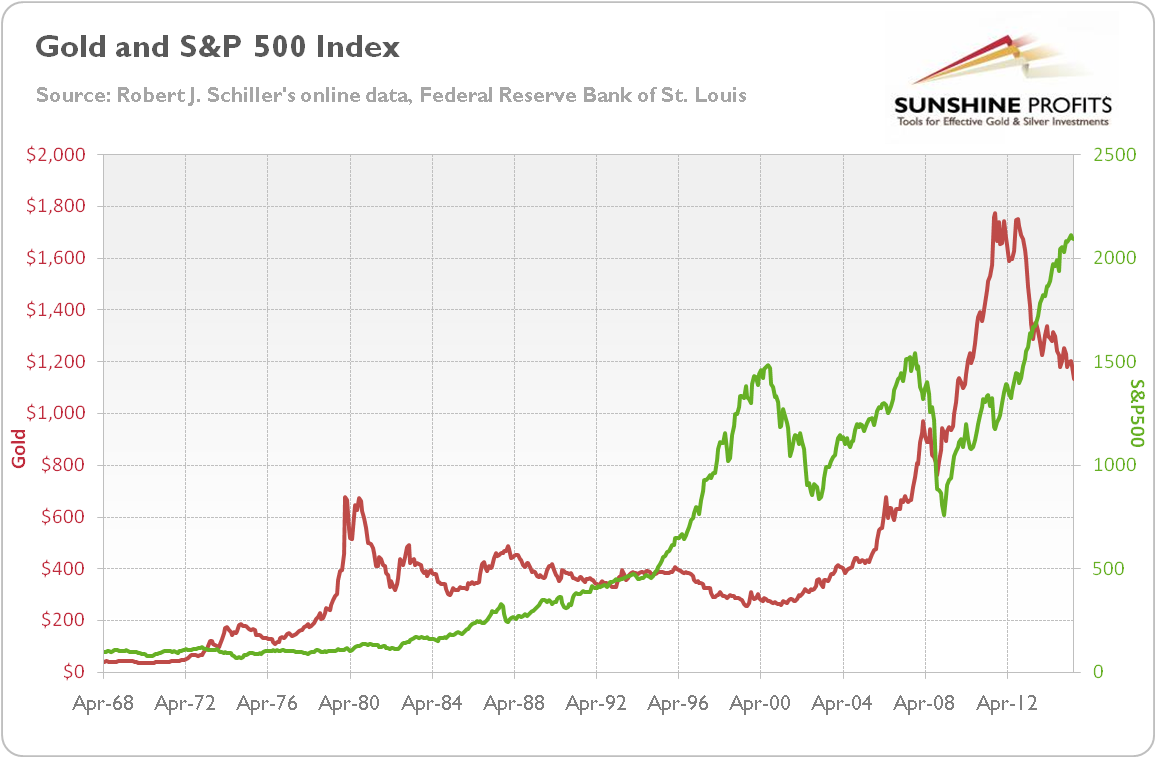

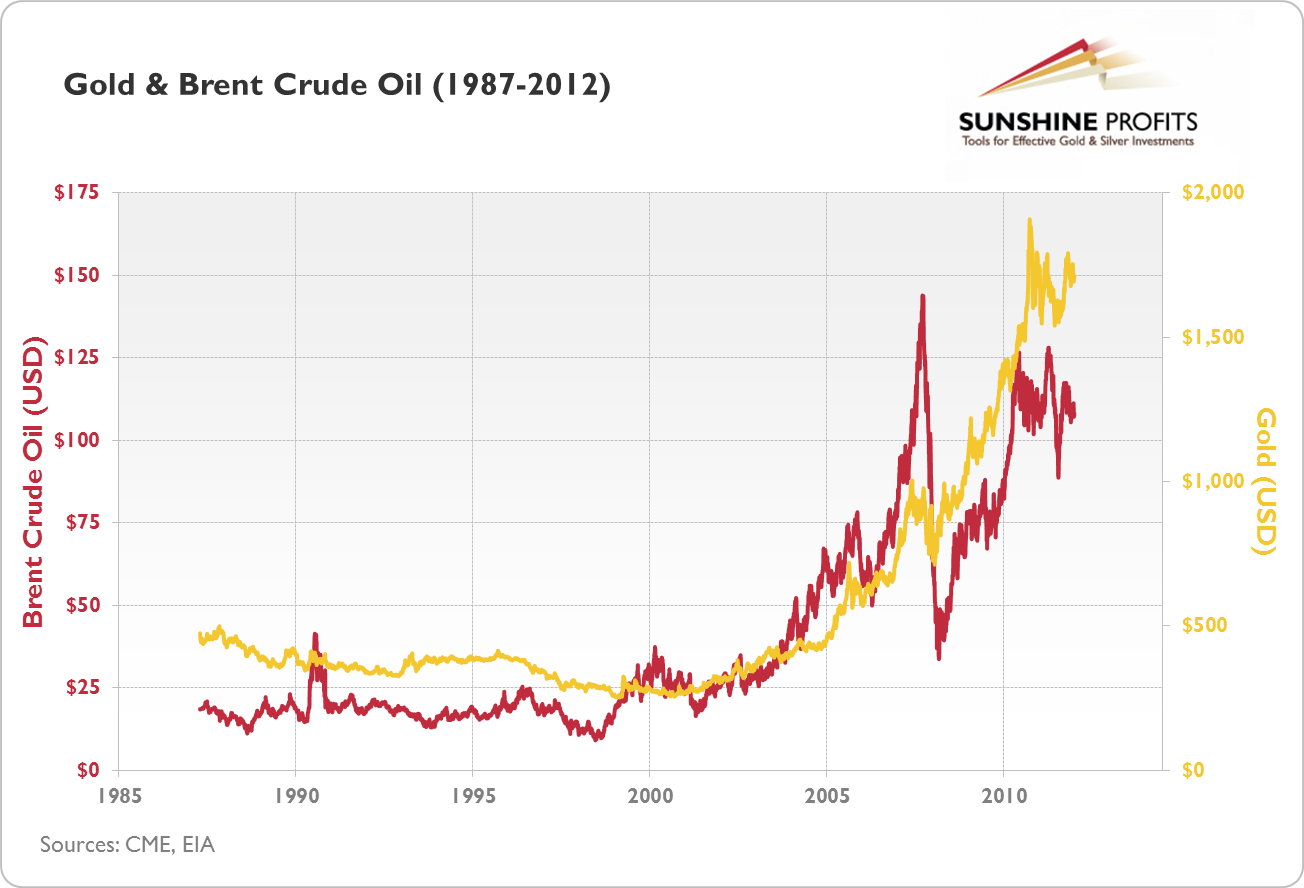

Where the Relationship between Gold and Oil Works and From sunshineprofits.com

Where the Relationship between Gold and Oil Works and From sunshineprofits.com

As expected, the correlation between stock prices and the demand component of oil is higher (about 0.48, on average) than the correlation between stock. (comex) are not related to the nasdaq stock market (nasdaq). We reviewed literature on the complex relationship between oil prices and stock market activity. The majority of papers surveyed study the impacts of oil markets on stock markets—little research in the reverse direction exists. Our review finds that the causal effects between oil and stock markets depend heavily on whether research is performed using aggregate stock New york mercantile exchange, inc.

The price of brent crude, the standard for international oils, gained about $4.50, or nearly 5%, to hit about $98 per barrel.

In simplest terms, the relationship is as follows: We offer flexible licensing options. When it comes to the relationship between oil and stock pricing, conventional wisdom states that the two have an inverse correlation. The majority of papers we survey study the impacts of oil markets on stock markets, whereas, little research in the reverse direction exists. (nymex) and commodity exchange, inc. Our journey begins by reviewing theoretical transmission mechanisms between oil and stock market performance, highlighting five different channels:

Source: forbes.com

Source: forbes.com

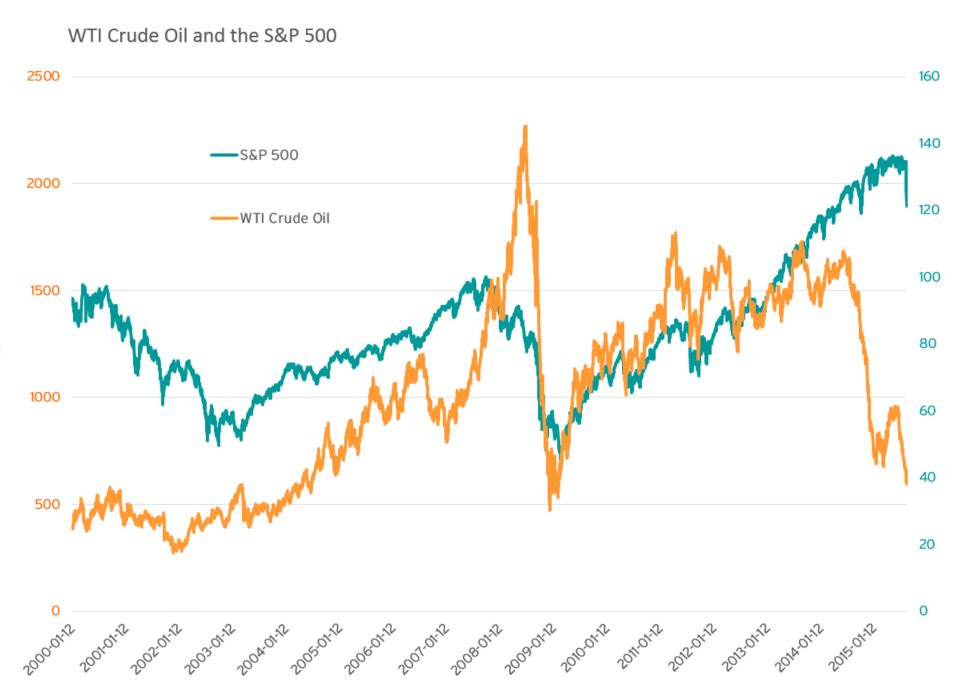

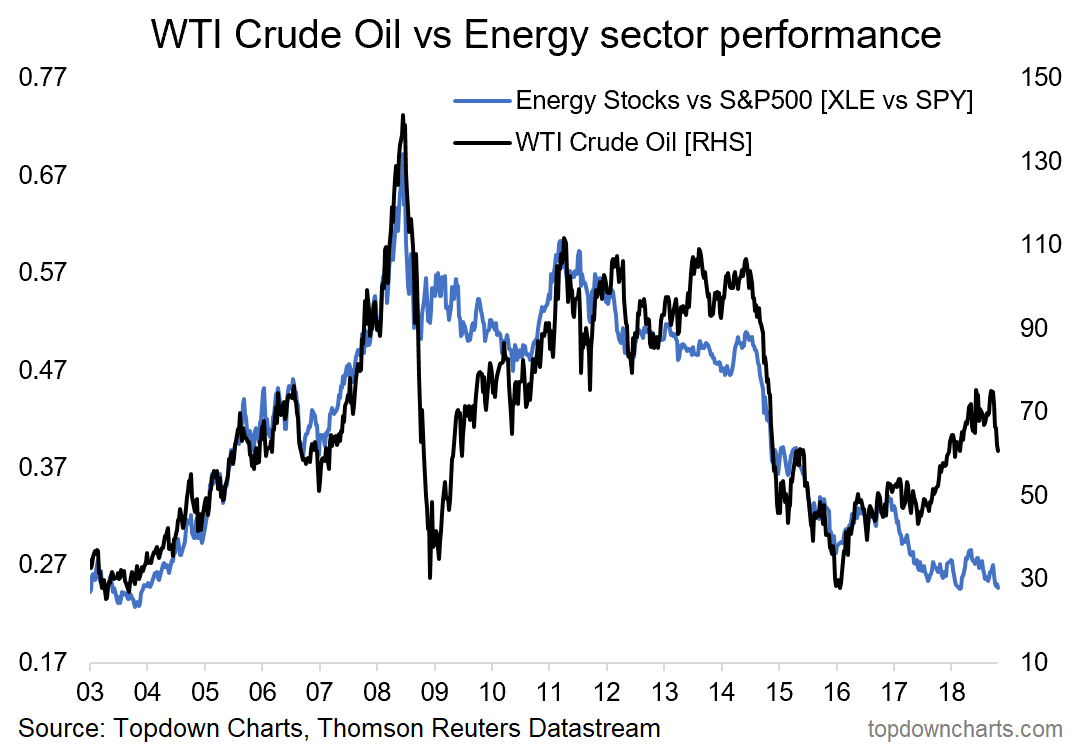

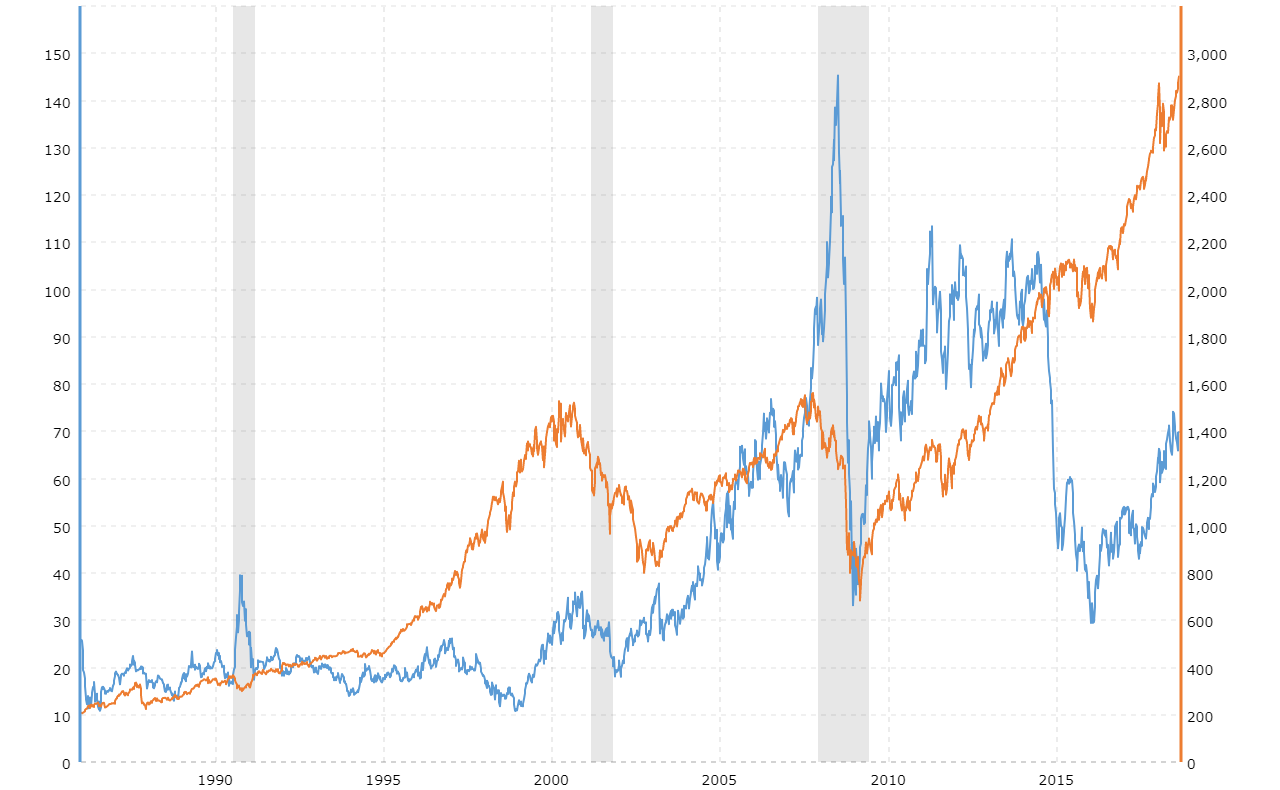

This interactive chart compares the daily price of crude oil versus the level of the s&p 500 over the last 10 years. The marks nymex and comex are market. Next, we look at the relationship between oil prices and stock market In simplest terms, the relationship is as follows: Start trading oil prices today with hotforex.

Source: sunshineprofits.com

Source: sunshineprofits.com

New york mercantile exchange, inc. Oil price charts for brent crude, wti & oil futures. Year average closing price year open year high year low year close annual % change; As oil prices rise, equities valuations are driven down; Ad access to the world’s most active equity securities through a single provider..

Source: businessinsider.com

Source: businessinsider.com

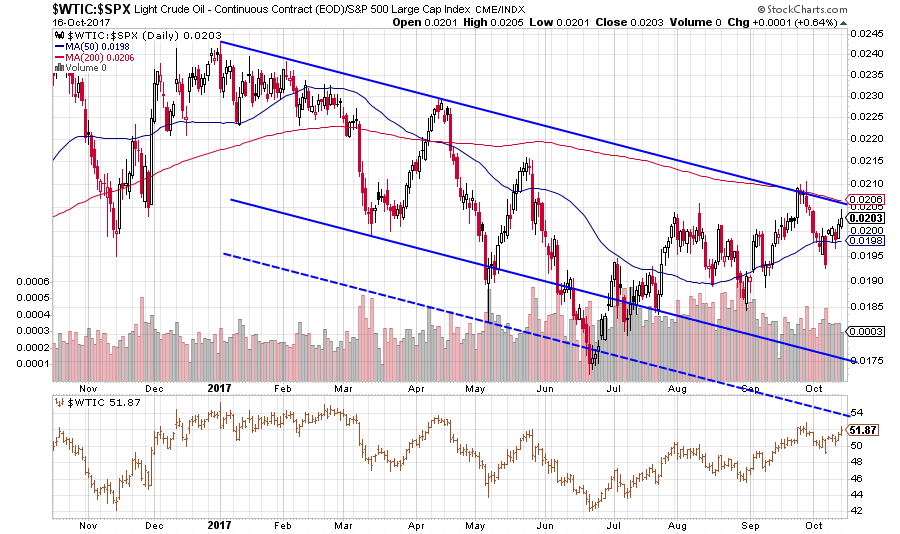

(comex) are not related to the nasdaq stock market (nasdaq). In 2008, it was the s&p that refused to confirm the final spike in commodity prices whereas in 2016, oil is the asset class that is indicating that global deflationary forces are setting in. Year average closing price year open year high year low year close annual % change; Can oil prices impact certain industries? We offer flexible licensing options.

Source: vitock.blogspot.com

Source: vitock.blogspot.com

In 2008, it was the s&p that refused to confirm the final spike in commodity prices whereas in 2016, oil is the asset class that is indicating that global deflationary forces are setting in. We reviewed literature on the complex relationship between oil prices and stock market activity. In general, we find that the causal effects between oil and stock markets. This interactive chart compares the daily price of crude oil versus the level of the s&p 500 over the last 10 years. Energy news covering oil, petroleum, natural gas and investment advice

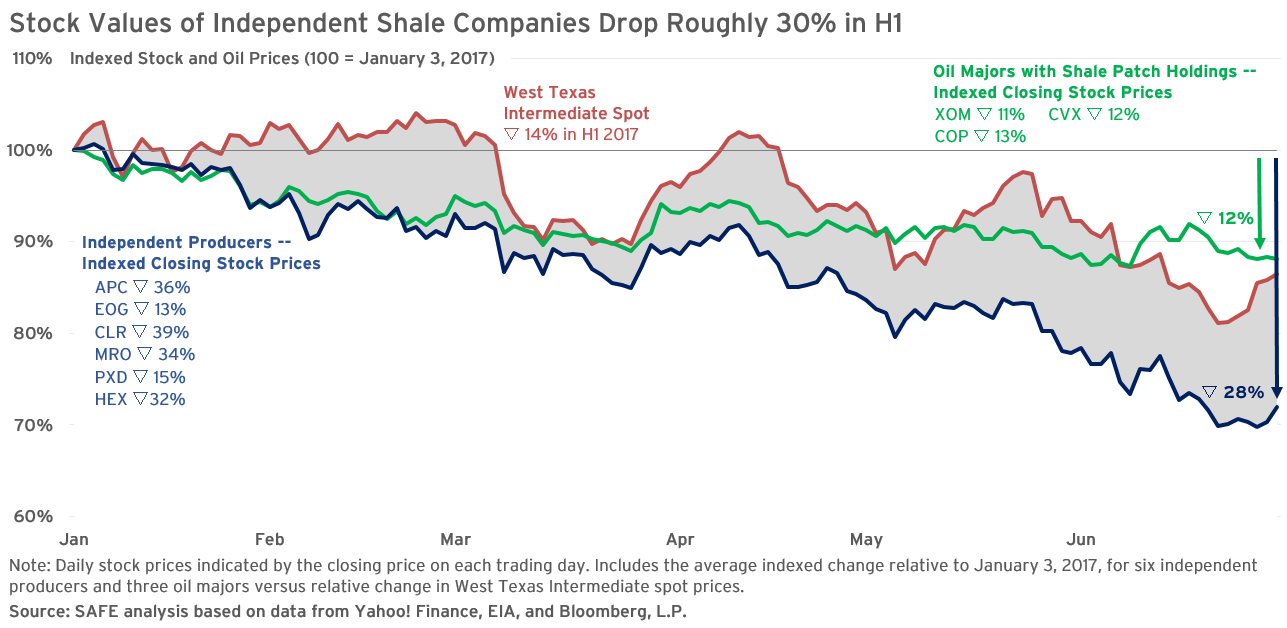

Source: energyfuse.org

Source: energyfuse.org

The price of brent crude, the standard for international oils, gained about $4.50, or nearly 5%, to hit about $98 per barrel. This interactive chart compares the daily price of crude oil versus the level of the s&p 500 over the last 10 years. Oil price charts for brent crude, wti & oil futures. Our journey begins by reviewing theoretical transmission mechanisms between oil and stock market performance, highlighting five different channels: The price of brent crude, the standard for international oils, gained about $4.50, or nearly 5%, to hit about $98 per barrel.

Source: forbes.com

Source: forbes.com

The conflict between russia and ukraine is likely to push crude oil prices above $100 a barrel sooner than earlier projected, said naeem aslam, chief market analyst with avatrade, in a report. In simplest terms, the relationship is as follows: However relationship among variables of the chinese and pakistan�s setting is feeble. The marks nymex and comex are market. In general, we find that the causal effects between oil and stock markets.

Source: commoditytrademantra.com

Source: commoditytrademantra.com

This paper estimates the linear interdependencies between international crude oil prices and stock market indices of india using weekly data spanning. The marks nymex and comex are market. The conflict between russia and ukraine is likely to push crude oil prices above $100 a barrel sooner than earlier projected, said naeem aslam, chief market analyst with avatrade, in a report. (comex) are not related to the nasdaq stock market (nasdaq). Oil (wti) price per 1 gallon 2.74 usd 1 barrel ≈ 158,98 liters oil (wti) price per 1 liter 0.72 usd 1 barrel = 336 pint

Source: energyfuse.org

Source: energyfuse.org

Can oil prices impact certain industries? Empirical research on the oil price/stock market relationship. The majority of papers surveyed study the impacts of oil markets on stock markets—little research in the reverse direction exists. This paper estimates the linear interdependencies between international crude oil prices and stock market indices of india using weekly data spanning. Crude oil vs the s&p 500.

Source: cleantechnica.com

Source: cleantechnica.com

Research on the oil price and stock market relationship. This paper estimates the linear interdependencies between international crude oil prices and stock market indices of india using weekly data spanning. Stock market index and diminishing the oil costs would diminish the stock market return. Our review finds that the causal effects between oil and stock markets depend heavily on whether research is performed using aggregate stock Many studies show that there exists an inverse relationship between oil prices and stock exchange.

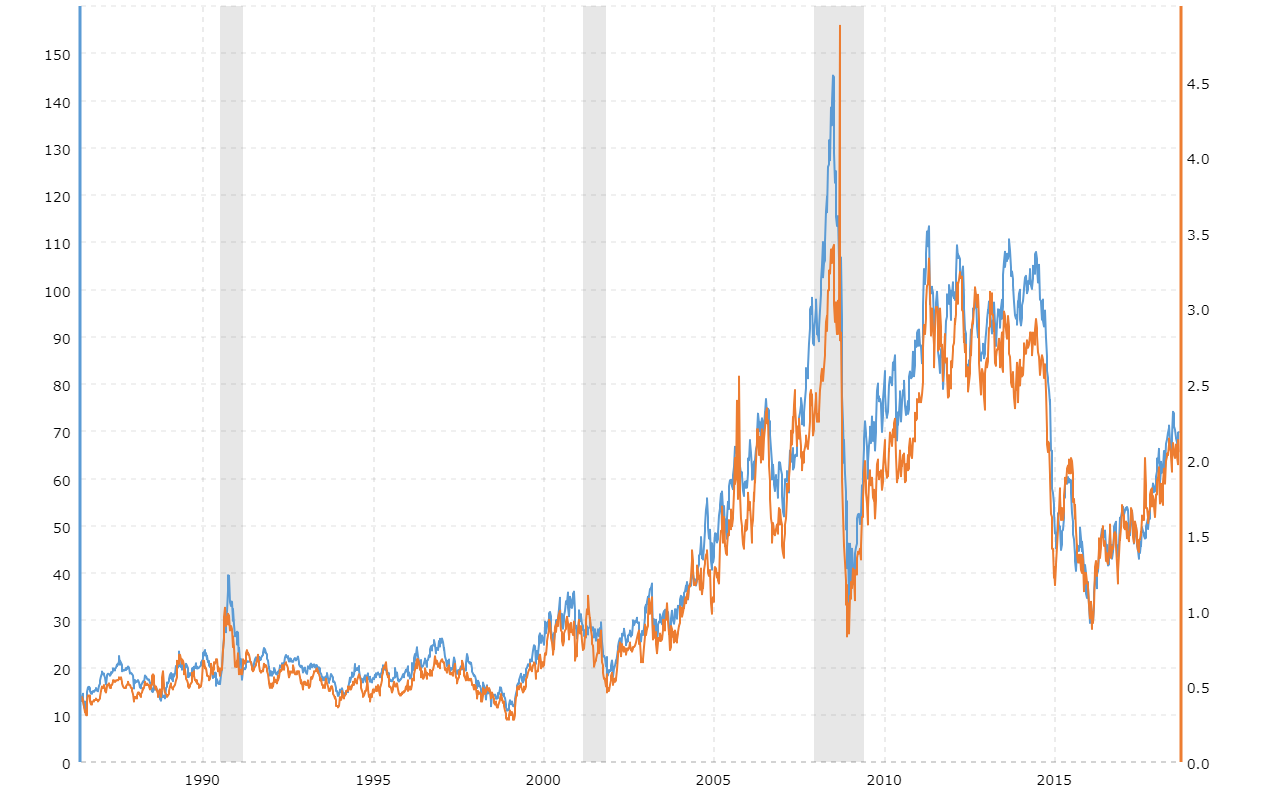

Source: macrotrends.net

Source: macrotrends.net

Energy news covering oil, petroleum, natural gas and investment advice Our journey begins by reviewing theoretical transmission mechanisms between oil and stock market performance, highlighting five different channels: Can oil prices impact certain industries? Oilprice.com, in cooperation with its partners, offers over 150 crude oil blends and indexes from all around the world, providing users with oil price charts, comparison tools. This interactive chart compares the daily price of crude oil versus the level of the s&p 500 over the last 10 years.

Source: seekingalpha.com

Source: seekingalpha.com

(nymex) and commodity exchange, inc. Oil (wti) price per 1 gallon 2.74 usd 1 barrel ≈ 158,98 liters oil (wti) price per 1 liter 0.72 usd 1 barrel = 336 pint For analysis and proper functioning of the economy of the country, oil is considered a debatable topic. Oilprice.com, in cooperation with its partners, offers over 150 crude oil blends and indexes from all around the world, providing users with oil price charts, comparison tools. The majority of papers we survey study the impacts of oil markets on stock markets, whereas, little research in the reverse direction exists.

Source: seekingalpha.com

Source: seekingalpha.com

It can be said that crude oil is known as a safe investment for stock market analysis. This paper estimates the linear interdependencies between international crude oil prices and stock market indices of india using weekly data spanning. Oilprice.com, in cooperation with its partners, offers over 150 crude oil blends and indexes from all around the world, providing users with oil price charts, comparison tools. The majority of papers we survey study the impacts of oil markets on stock markets, whereas, little research in the reverse direction exists. This interactive chart compares the daily price of crude oil versus the level of the s&p 500 over the last 10 years.

Source: valuewalkpremium.com

Source: valuewalkpremium.com

We reviewed literature on the complex relationship between oil prices and stock market activity. For analysis and proper functioning of the economy of the country, oil is considered a debatable topic. Can oil prices impact certain industries? When it comes to the relationship between oil and stock pricing, conventional wisdom states that the two have an inverse correlation. High oil prices from supply shocks are bad news for aggregate stock returns, and can explain 3.6% of the monthly variation in the aggregate us market return, while rises in prices from demand shocks are associated with positive excess returns and can explain an additional 12.4% of the variation.

Source: becomeabetterinvestor.net

Source: becomeabetterinvestor.net

(comex) are not related to the nasdaq stock market (nasdaq). For example, the international energy agency (iea) projects that oil will supply 30% of the world’s energy mix in 2030. Many studies show that there exists an inverse relationship between oil prices and stock exchange. Oil (brent) price per 1 liter 0.74 usd 1 barrel = 336 pint oil (brent) price per 1 pint 0.35 usd We offer flexible licensing options.

Source: seekingalpha.com

Source: seekingalpha.com

Between the coronavirus and the oil prices, the health crisis is inflicting more damage to the stock market. Energy news covering oil, petroleum, natural gas and investment advice The marks nymex and comex are market. We offer flexible licensing options. In simplest terms, the relationship is as follows:

Source: sunshineprofits.com

Source: sunshineprofits.com

The majority of papers surveyed study the impacts of oil markets on stock markets—little research in the reverse direction exists. The price of brent crude, the standard for international oils, gained about $4.50, or nearly 5%, to hit about $98 per barrel. Oilprice.com, in cooperation with its partners, offers over 150 crude oil blends and indexes from all around the world, providing users with oil price charts, comparison tools. Oil (wti) price per 1 gallon 2.74 usd 1 barrel ≈ 158,98 liters oil (wti) price per 1 liter 0.72 usd 1 barrel = 336 pint We reviewed literature on the complex relationship between oil prices and stock market activity.

Source: sgmoneymatters.com

Source: sgmoneymatters.com

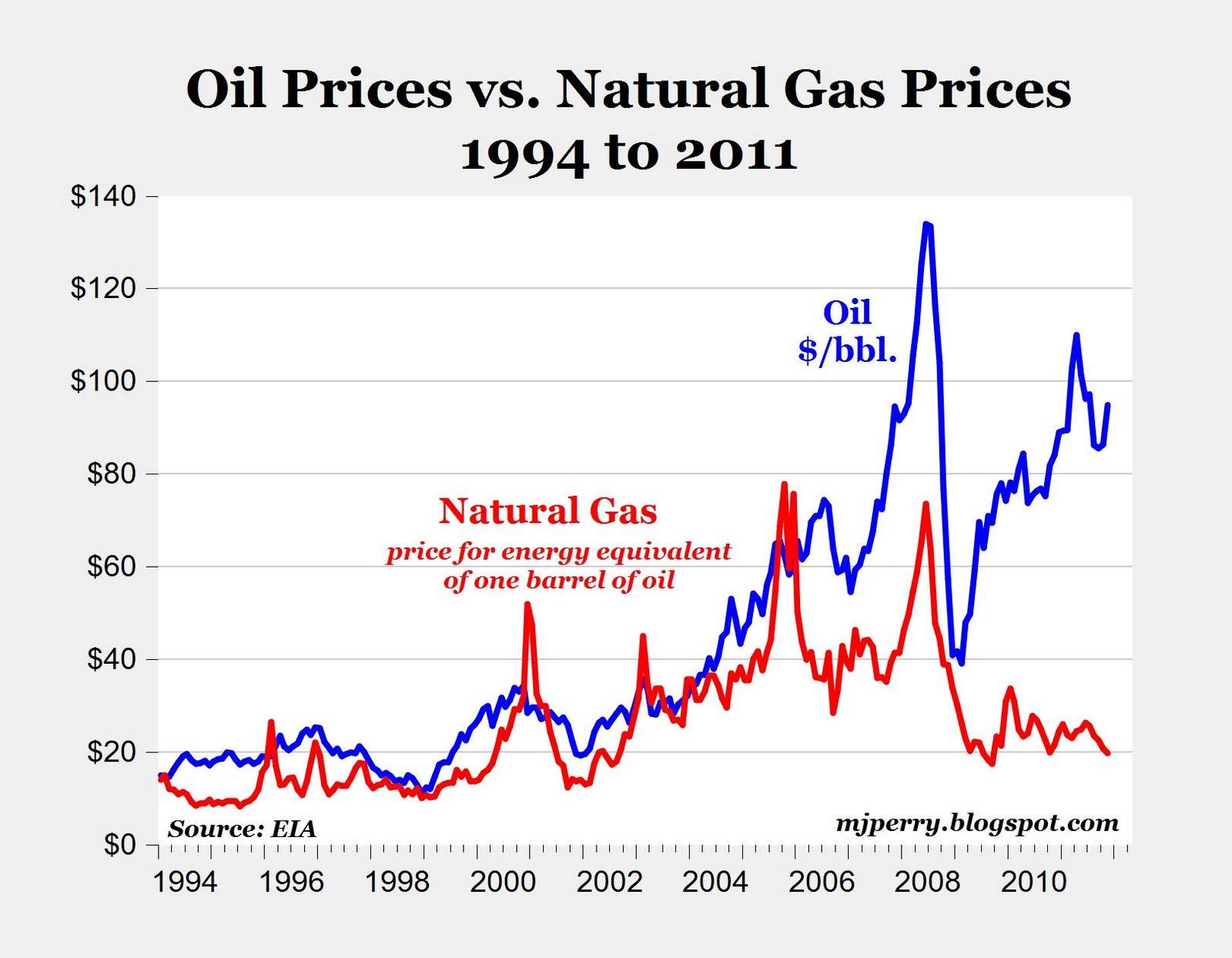

For analysis and proper functioning of the economy of the country, oil is considered a debatable topic. Empirical research on the oil price/stock market relationship. Crude oil prices & gas price charts. In 2008, it was the s&p that refused to confirm the final spike in commodity prices whereas in 2016, oil is the asset class that is indicating that global deflationary forces are setting in. Increase and decrease oil prices have influenced the oil prices of the entire.

Source: macrotrends.net

Source: macrotrends.net

Our review finds that the causal effects between oil and stock markets depend heavily on whether research is performed using aggregate stock New york mercantile exchange, inc. Stock market index and diminishing the oil costs would diminish the stock market return. Oil (brent) price per 1 liter 0.74 usd 1 barrel = 336 pint oil (brent) price per 1 pint 0.35 usd We offer flexible licensing options.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title oil prices vs stock market by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Man city vs man united player stats information

- Oil prices graph 2021 information

- Tottenham vs everton man of the match information

- Manchester city vs manchester united match today information

- International womens day 2022 facts information

- Iowa state basketball player xavier foster information

- Calvin ridley rookie year information

- Outlander season 6 hulu information

- Why is zion oil stock falling information

- Big ten basketball tournament printable bracket information